START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

5 Effective Ways to Tackle the Family Office Market

The family office landscape is opaque by nature. This makes finding, approaching and maintaining strong relationships with those in the private wealth space daunting and laborious tasks for many. Given the unique standards, most individuals and funds targeting this wealth channel require a creative approach to ensure effective engagement. Luckily, progressive growth in the space combined with an upward shift in transparency makes reaching family offices a considerably simpler process than ever before. To ensure effective engagement with these remote entities, FINTRX has outlined several best practices for crafting a pitch that turns heads and gets funds.

Prior to comprehensive family office intelligence platforms such as FINTRX, many capital raisers found it difficult to access these private markets, let alone secure a deal with a family office. Increased sophistication and innovative technologies helped to improve and facilitate this essential operational need - many of which have been specifically designed for this sector.

1. Understand the Family Office Landscape

To successfully engage family office investors, it is vital to have a well-versed understanding of the intricacies of the space - as trends and strategies are constantly changing and presenting unpredictable factors that could alter initial strategies. Start by analyzing their portfolios to determine if you have any aligned interests. How would your venture add value or help diversify its portfolio? Another simplified approach is to research individuals in the space that have successfully raised capital from a family office before. This will provide you with unexpected opportunities to expand your family office network. To find and attract the most suitable family office, you must have a solid understanding of the industry.

2. Find Commonalities & Expound On Them

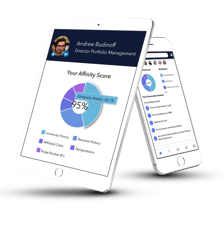

In order to create valuable relationships with family office investors, you must first get your foot in the door. In the past, expanding your family office network often involved leveraging colleagues and contacts at conferences to form a web of valuable connections. Now, this web of connections lives in a seamless digital universe - one that is advanced enough to expand your network through existing connections. Find and explore commonalities you share with the key decision-makers at the family offices. Nuggets such as shared alumni roots, previous employment history, overlapping years at previous stops, board, charities that you share - even passions you share outside of work. Our data shows these to be incredibly impactful and productive ways to spark meaningful conversations. You can do this manually within your own network, or leverage technology and evolving algorithms with an offering like our FINTRX Affinity solution.

3. Persistent & Polite Follow Up

It is critical to have an implemented plan for staying connected with those in the family office realm. Whether it is a phone call, email, or in-person meeting, ensuring a strategic follow-up shows your seriousness and interest in working with them. Another strategy that helps in securing a deal with a family office is to provide actionable or informative links, articles, or other useful resources that drive value. Doing so helps strengthen your relationship and subtly markets you or your firm as a promising business option.

4. Create Value

Most, if not all, business ventures are created to fulfill a need or want of some sort. Craft your pitch around this idea... ask yourself how you would either add value to the family office or show how you are different - especially if you may not be the most attractive investment opportunity, or if you haven't already raised 'X' amount with a long track record of performance. How does your product, service, or involvement move the needle & stand out? Whatever it may be - see if there is something that might help 'build their legacy' by changing the world with you - while also compounding capital.

5. Know Their 'Why'

Every family office is different regarding what is most important to them in their investment thesis and specific needs. Some may focus strictly on producing the best returns, while others are more focused on impact-driven investments that not only provide a strong return but also help improve our environment or society. Because each group is so distinct in its structure and objectives, it is imperative to know their 'why' so that you can take the most tailored approach when seeking a group to pitch. Remember to target the groups that best suit your needs - and vice versa.

FINTRX provides comprehensive data intelligence on 850,000+ family office & investment advisor records, each designed to help you identify, access and map the private wealth ecosystem. Explore in-depth dossiers on each family office & investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors & industries of interest, and advisor growth signals among other key data points.

Additionally, FINTRX provides insight and expansive contact information on 850,000+ decision-makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, brief bios & much more.

For an in-depth exploration of the FINTRX family office platform, click below.

For more practical family office insights and best practices, visit our newly renovated 'Resource Library' below.

Written by: Renae Hatcher |

November 20, 2019

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

FROM THE BLOG

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)