AI to Identify, Analyze, and Engage Prospects

FINTRX isn’t just a database—it’s an AI-powered private wealth intelligence platform that delivers speed, precision, and clarity to identify the right prospects, target key decision makers, and gain real-time insights across the RIA and family office ecosystem.

How Our Clients Rely on FINTRX AI

"Having that extra tool like AI Analyst that helps craft messaging or prep for a meeting is very valuable. It’s scary cool." - Carl Berg, F/m Investments

"The AI helps us quickly find the right information, even when we're not sure what to look for." - Jooliana Krummel, Merit Financial Advisors

"The AI Analyst feature has been a game-changer, providing powerful talking points, email templates, and scripts that have completely transformed out approach to advisor prospecting." - Darryn Bolden, Great Gray Trust Company

"FINTRX is the best tool I use daily!" - Colby Tallafuss, Milemarker

FINTRX AI SEARCH

Natural Language AI Search

Say goodbye to static databases and the hassle of sifting through filters, fields, and data points. FINTRX translates your plain-language queries into targeted prospect lists in seconds—no manual filtering required.

.png?width=740&name=AI%20Search%20Graphics%20(4).png)

FINTRX AI ELEMENTS

Create Data With AI Prompts

Create fully custom data fields using simple natural language prompts and watch FINTRX AI instantly generate structured data points across RIA, broker-dealer, wealth team, and family office records.

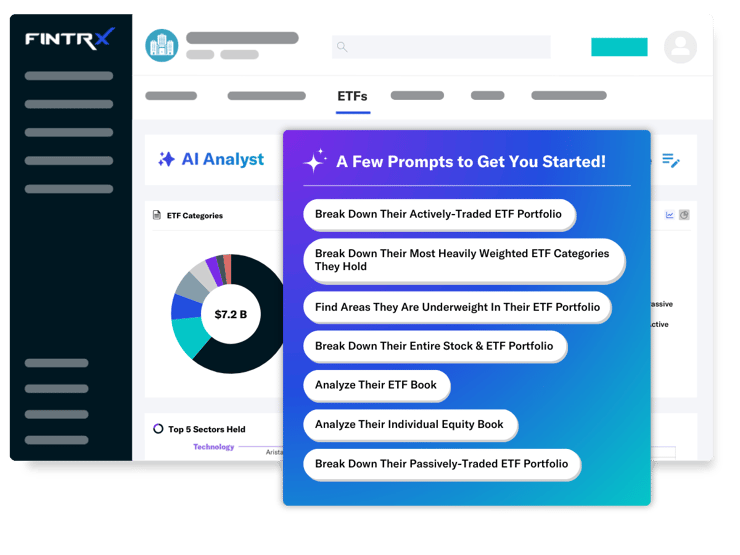

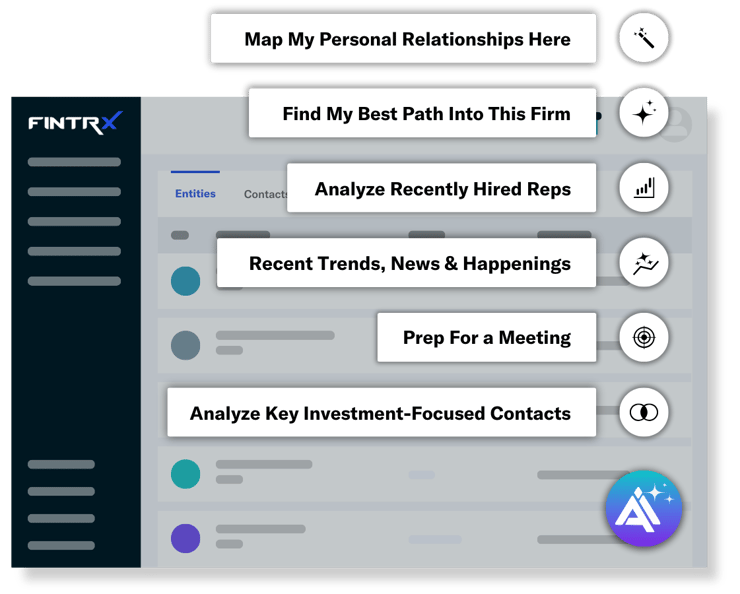

FINTRX AI ANALYST

Your Dedicated AI Analyst

FINTRX AI Analyst is your built-in private wealth analyst, delivering real-time, contextual insights across every firm, contact, and investment you view. From identifying key decision-makers and recent capital activity to interpreting AUM trends and ETF shifts, AI Analyst surfaces what matters—instantly.

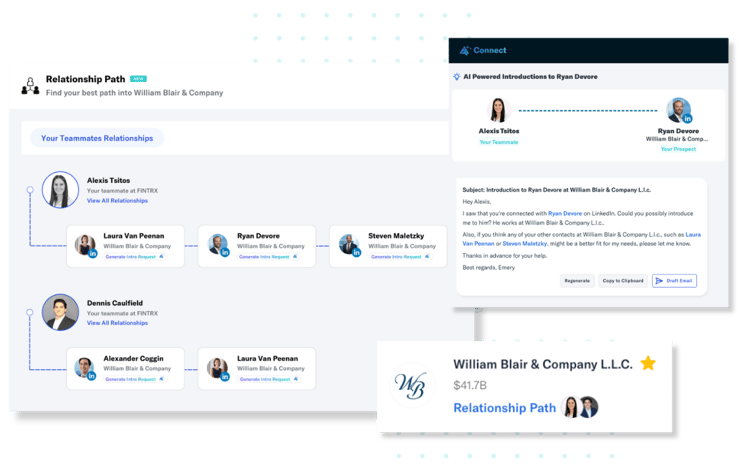

FINTRX RELATIONSHIP PATH

Powerful Relationship Mapping

FINTRX Relationship Path surfaces the strongest paths to decision-makers using shared affiliations, past firms, and mutual connections—helping identify warmest paths for outreach.

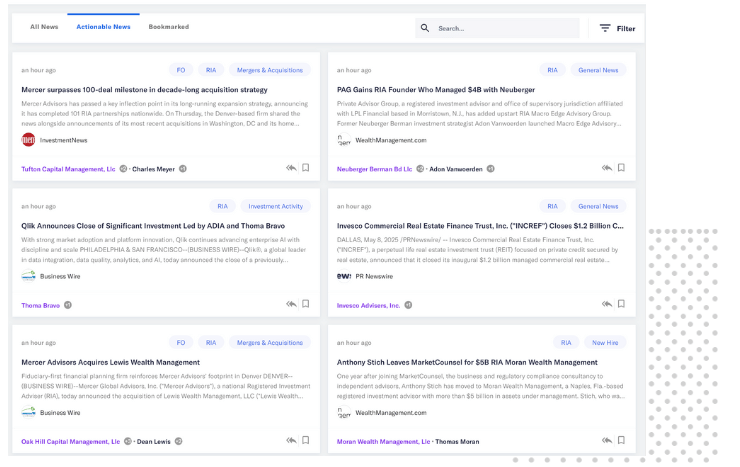

FINTRX AI NEWS SUMMARIES

Real-Time News & Trends

Stop scanning headlines. FINTRX AI analyzes market activity and firm-specific news to surface relevant, actionable updates—letting your tailor your messaging and saving you hours of prep.

Frequently Asked Questions

What is FINTRX AI and how does it work?

FINTRX AI is a suite of integrated tools that apply advanced machine learning and natural language processing to private wealth data—enabling smarter prospecting, faster analysis, and more strategic relationship-building across RIAs, family offices, and broker-dealers.

How is FINTRX AI different from traditional data platforms?

Unlike static databases, FINTRX AI actively interprets data, maps relationships, and surfaces insights—so you're not just accessing contacts, you're understanding who to approach, how to reach them, and when to engage for maximum impact.

What is AI Search and why is it better than filters?

AI Search lets you ask questions in plain language (e.g., “Show me firms with recent fintech exits”) and instantly delivers targeted results. It removes the need for complex filtering and accelerates list-building dramatically.

What insights does AI Analyst provide?

AI Analyst delivers instant, contextual insights on firms and contacts, including AUM trends, ETF allocations, investment activity, capital movement, and decision-maker identification—available directly within your workflow.

How does FINTRX AI support large-scale outreach efforts?

With Bulk AI Actions, users can analyze up to 25 firms or contacts simultaneously, generating tailored insights and uncovering high-fit prospects at scale—ideal for conferences, campaigns, and territory planning.

Does FINTRX use AI to collect and verify data?

Accuracy is core to FINTRX. Our AI enhances—but never replaces—verified data. All AI insights are layered on top of a continuously updated database maintained by a 70+ person research team for unmatched data integrity.

FROM THE BLOG

5 Reasons Asset Managers are Ditching Their Legacy Providers and Switching to FINTRX

The days of static, outdated wealth intelligence are over. Asset managers who switch to FINTRX gain a real-time, AI-powered edge over competitors still relying on legacy providers. Here are five key reasons why asset managers are making the switch.

Discover the AI transforming private wealth prospecting today

RESILIENCY

Since preparation is a key ingredient to success, our team focuses on resiliency and planning when it comes to customer data.

Get Our Daily Coronavirus Tracker Insights Sent to Your Inbox

Get Our Daily Coronavirus Tracker Insights Sent to Your Inbox

.png?width=220&height=57&name=all%20white%20fintrx%20logo%20(2).png)

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)