![]()

Compare FINTRX vs PitchBook: From Institutional Insight to Private Wealth Access

PitchBook and FINTRX are both trusted data platforms—each excelling in different areas. While PitchBook offers deep insight into private equity, venture capital, and institutional investors, FINTRX is purpose-built to help asset managers identify and engage RIAs and family offices. Together, they provide full-spectrum visibility—from macro-level trends to targeted private wealth outreach.

Built for Private Wealth Prospecting

Built for Private Wealth Prospecting

FINTRX is purpose-built to help fundraisers penetrate the RIA and family office landscape — offering granular insights on advisor teams, family office principals, AUM, product usage, and investment preferences. PitchBook focuses more broadly on institutional LPs and deal flow.

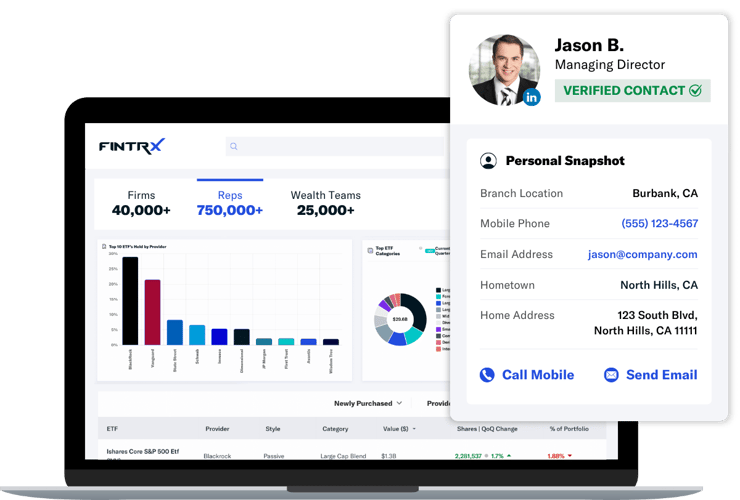

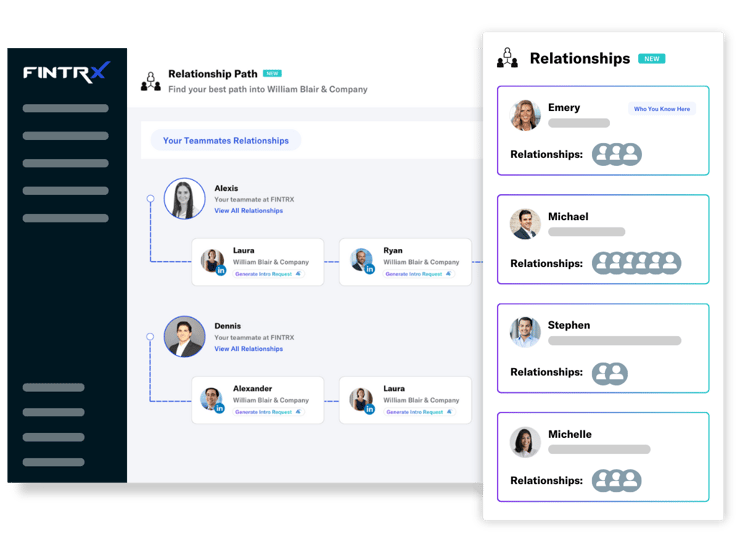

Deeper, Sales-Ready Contact Intelligence

Deeper, Sales-Ready Contact Intelligence

FINTRX provides direct decision-maker contacts, team structures, and LinkedIn-powered relationship pathing to uncover the best warm intro. PitchBook focuses on firm-level data and historical deal flow.

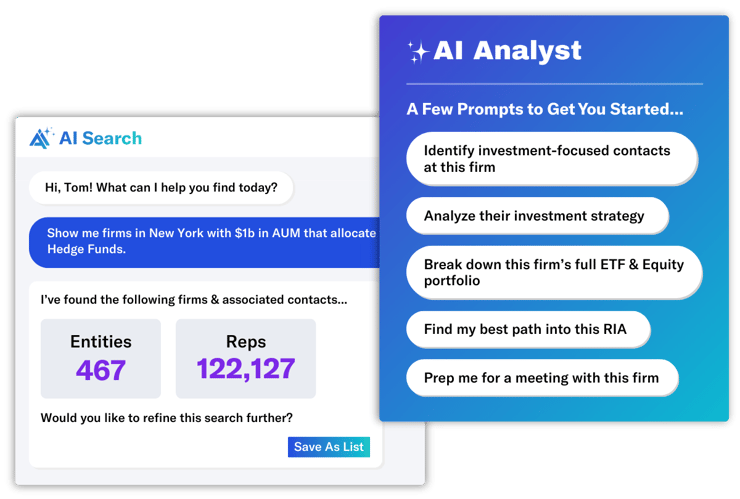

AI To Unlock the Private Wealth Channel

AI To Unlock the Private Wealth Channel

FINTRX AI streamlines RIA and family office prospecting with natural language search, relationship mapping, intelligent firm summaries, and automated outreach workflows. PitchBook leverages AI primarily for private market research.

DATA YOU CAN TRUST

Unmatched Private Wealth Data

FINTRX provides deep coverage of the private wealth ecosystem with detailed contact-level data, AUM & accounts, investment history, and firm-level intelligence—empowering distribution teams to identify, access, and engage high-value prospects across the RIA and family office channels. Including...

- 750,000+ Registered Reps

- 40,000+ Investment Advisory Firms

- 4,300+ Single & Multi Family Offices

- 25,000+ Family Office Contact Profiles

INDUSTRY-LEADING AI

AI-Powered Prospecting Tools

The FINTRX platform provides powerful AI to help fundraisers identify, engage, and convert RIA and family office prospects with speed and precision.

- Natural Language Search

- Integrated AI Analyst

- AI-Powered Relationship Mapping

- Smart News Alerts & Notifications

DATA WHERE YOUR TEAM LIVES

CRM Integrations

FINTRX integrates natively with leading CRM platforms such as Salesforce, HubSpot, Microsoft Dynamics, and DealCloud. Data is also available through data feeds, APIs, and Snowflake.

- Send FINTRX records directly to you CRM

- Generate new leads and keep existing records up to date

- Enrich your existing data

SUPPORT THAT UNDERSTANDS YOUR BUSINESS

Trusted Team of Experts

FINTRX doesn’t just teach the platform — we help build your go-to-market. Our team brings deep private wealth industry expertise, with professionals who have worked at leading financial data providers and investment firms, giving us a unique advantage in understanding market gaps, data challenges, and the real needs of asset raisers and business development teams.

- Natural Language Search

- Integrated AI Analyst

- AI-Powered Relationship Mapping

- Smart News Alerts & Notifications

Hear What Our Clients Have to Say

"FINTRX has professionalized our family office outreach in the same way that CapitalIQ and PitchBook did for PE and VC funds." - Jenny Poth, Ziegler Investment Bank

FROM THE BLOG

5 Reasons Asset Managers are Ditching Their Legacy Providers and Switching to FINTRX

The days of static, outdated wealth intelligence are over. Asset managers who switch to FINTRX gain a real-time, AI-powered edge over competitors still relying on legacy providers. Here are five key reasons why asset managers are making the switch.

.png?width=220&height=57&name=all%20white%20fintrx%20logo%20(2).png)

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)