START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Family Offices Continue to Get Younger & Trend Toward Impact Investing

Several indicators highlight the continuously growing trend of family offices increasing their allocations to impact-focused funds and companies. To understand this trend, let us begin with the overall spike in the prevalence of environmental, social and governance investing. As research continuously suggests that ESG investing is not only ethically responsible but fiscally advantageous, businesses, asset managers and private investment groups have been constructing their strategies and portfolios with ESG considerations. One common argument made by proponents of impact investing is that by tailoring strategies to include ethically responsible opportunities, investors are simultaneously establishing a more sustainable overall strategy.

Family Offices Continue to Get Younger & Trend Towards Impact Investing

Supplementing this logical argument in support of ESG investing is a more ethically grounded demand for responsible investment options, particularly within the family office market. Over the past twenty years, family offices have become the preeminent vehicle for the ultra-wealthy and expanded in number, partially because of a younger generation of tech moguls looking for adequate homes for their assets. This new generation of successful individuals, unlike their predecessors, were brought up with an ever-present awareness of environmental and ethical issues. Running alongside the Nouveau Family Office are long-standing multi-generational groups handing over the reins to a younger generation of family members. The result is a tsunami of wealth reaching the hands of millennials.

Data derived from FINTRX family office research illustrates this phenomenon results in a lower average age of decision makers within the space. It is apparent that this new generation of investors has a much larger appetite for impactful investments compared to their predecessors.

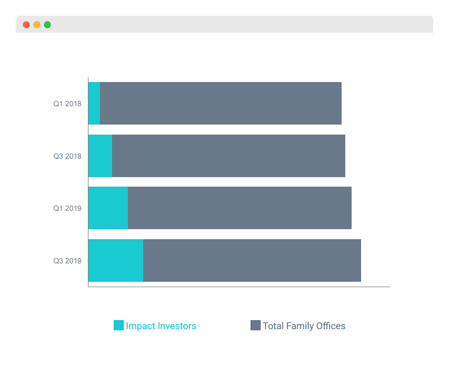

FINTRX data also depicts a staggering 14% increase in global family offices explicitly seeking exposure to impactful investments since January 2018.

Though the concept of impact investing is not a new idea, the drastic increase of younger investors inheriting enormous quantities of wealth has catalyzed the demand for ESG alternatives. As a result, more and more funds are tailoring their investment strategies to accommodate this increasing demand.

Perhaps favorable economic conditions have allowed for more investment liberties to be taken and the economic boom of the past decade has incubated the success of impact investments and in fact most industries. As the adage goes, a rising tide lifts all boats. ESG strategies have yet to be tested against a major market correction yet this doesn’t seem to deter young, ultra-wealthy individuals from pursuing these opportunities. Ultimately, time will tell if impact investing and traditional value investing are directly correlated, mutually exclusive, or somewhere in between.

FINTRX provides comprehensive data intelligence on 850,000+ family office & investment advisor records, each designed to help you identify, access and map the private wealth ecosystem. Explore in-depth dossiers on each family office & investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors & industries of interest, and advisor growth signals among other key data points.

Additionally, FINTRX provides insight and expansive contact information on 850,000+ decision-makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, brief bios & much more.

For an in-depth exploration of the FINTRX family office platform, click below:

Written by: Dennis Caulfield |

October 28, 2019

Vice President of Research at FINTRX powered by Cap Hedge Ventures

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)