START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

January 2020 Family Office Data Report

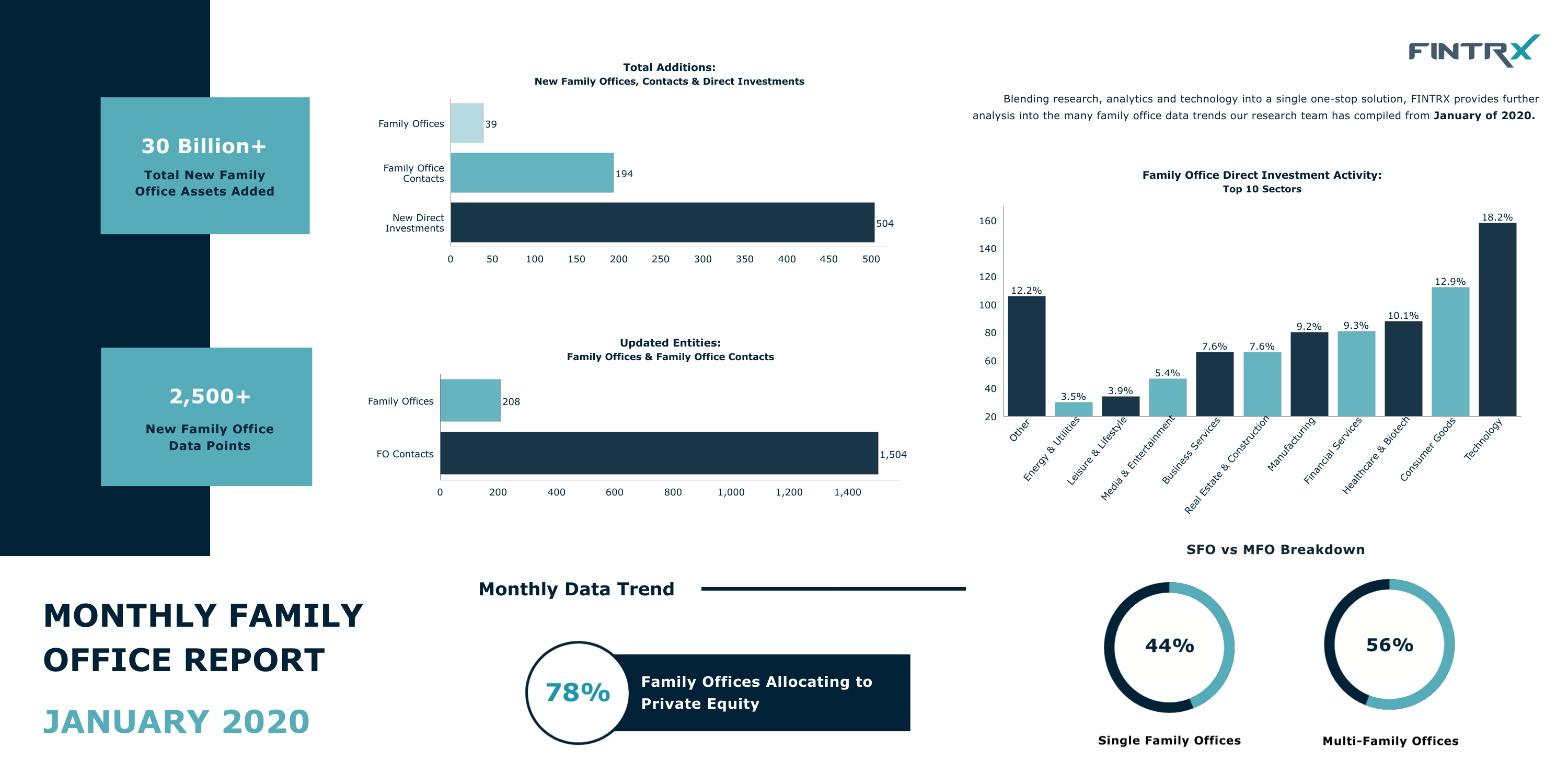

A vast array of the world's asset managers, bankers, private businesses and fund managers leverage the FINTRX platform to identify, access and raise family office capital. Blending research, analytics and technology into a single solution, we provided further analysis into the most prominent family office data trends our research team compiled from January of 2020. Continue reading for a complete breakdown on how last month unfolded within our ecosystem of 2,749+ family offices, 10,970+ family office contacts and 7,396+ tracked investments.

January Findings

→ New Family Office Data Points = 2,500+

→ Total New Family Office Assets Added = $30 Billion+

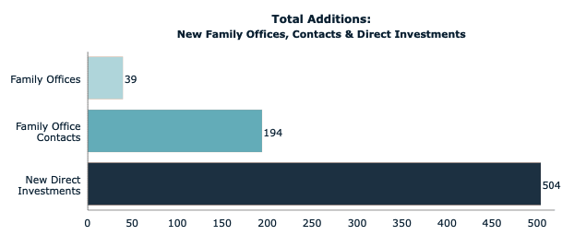

→ Total Additions = 737

- 39 family offices added

- 194 family office contacts added

- 504 new tracked investments

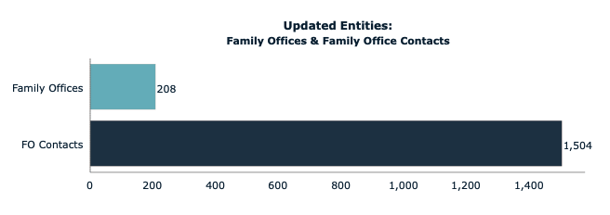

→ Updated Entities = 1,712

- 208 updated family offices

- 1,504 updated family office contacts

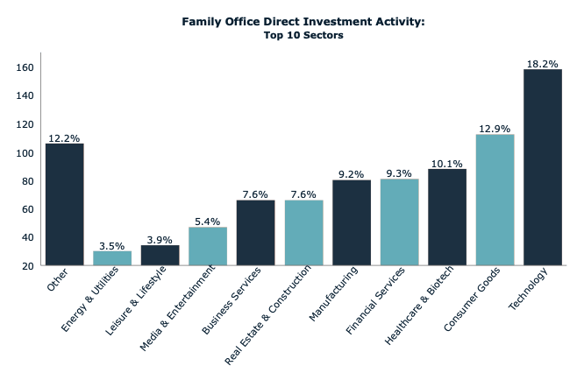

→ Family Office Direct Investment Activity by Sector

- Technology = 18%

- Consumer Goods = 13%

- Healthcare & Biotech = 10%

- Financial Services = 9%

- Manufacturing = 9%

- Real Estate & Construction = 8%

- Business Services = 8%

- Media & Entertainment = 5%

- Leisure & Lifestyle = 4%

- Energy & Utilities = 4%

- Other = 12%

→ Monthly Family Office Data Trend:

"Private equity continues to prevail as the most popular alternative asset class among single and multi-family offices. Their increasing level of sophistication and desire for returns will likely continue propelling family office allocations within the space, both through fund vehicles and via direct investments." - Dennis Caulfield, Vice President of Research

In providing continuously updated family office data, capital raising tools, and savvy search capabilities, FINTRX continues to bring transparency to the family office ecosystem. If you are interested in learning additional information on our proprietary research, please click here.

For an in-depth exploration of the FINTRX platform, request a free trial here:

Written by: Renae Hatcher |

February 14, 2020

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)