START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

FINTRX Q1 2019 Family Office Data Report

Q1 was a very busy quarter for our data and research team here at FINTRX. We kicked off 2019 by adding and updating hundreds of family office dossiers and key contacts within our platform. Below is a quick overview of our Q1 family office activity from 2019.

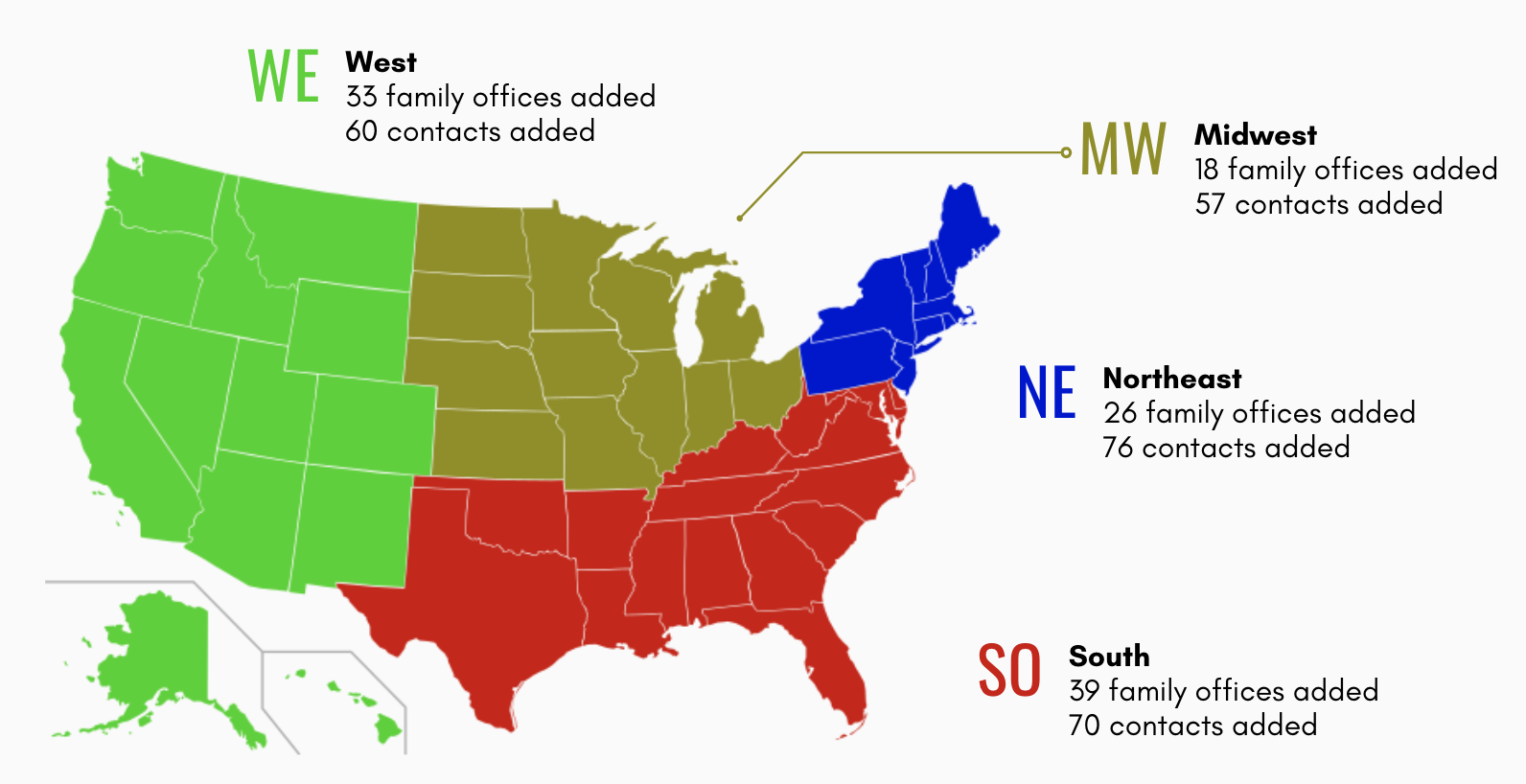

A total of 224 new family offices were added to FINTRX, including 91 single family offices and 133 multi-family offices. Nearly 10% of our North American additions were in Canada, with the remaining spread out across the major regions of the United States, as highlighted below:

Domestic states with the greatest activity:

- California - 146 family office updates & additions

- New York - 173 family office updates & additions

- Texas - 74 family office updates & additions

- Illinois - 59 family office updates & additions

- Florida - 56 family office updates & additions

In total, we added and updated 785 US-based family offices for the quarter.

>> click here to see the full report

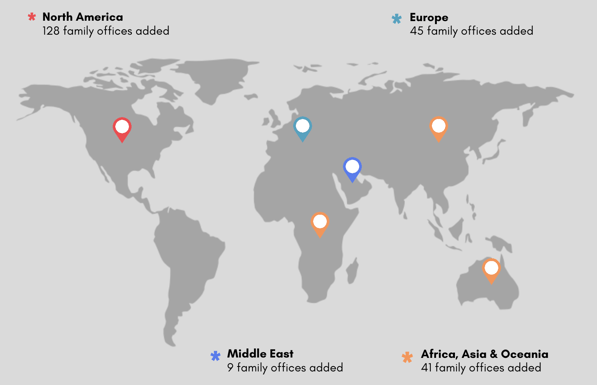

Our team also made significant progress to our international family office coverage. Globally, we realized a wide distribution of family office additions, as outlined below:

In Europe, some of the additions were in the following countries:

- Switzerland - 120 family office updates & additions

- United Kingdom - 114 family office updates & additions

- Netherlands - 19 family office updates & additions

In total, we added and updated 381 family offices in Europe during Q1.

>> click here to see the full report

Our data team also made substantial progress with regard to our family office coverage within Asia and the Middle East. Some of our notable activity is highlighted below:

- Singapore - 35 family office updates & additions

- Hong Kong - 35 family office updates & additions

- Middle East - 26 family office updates & additions

Alongside our family office activity, our team added and updated a total of 1,472 contacts for the quarter. In addition, the FINTRX research team identified and added 29 new family offices with an impact investment focus as part of their core thesis.

In providing continuously updated family office data, capital raising tools, and savvy search capabilities, FINTRX continues to bring transparency to the family office ecosystem. If you are interested in learning additional information on our proprietary data and research, click here.

For an in-depth exploration of the FINTRX family office platform, request a free trial here:

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)