START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

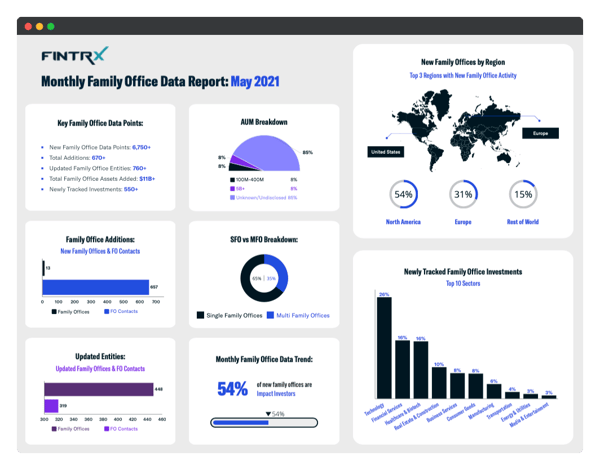

FINTRX Monthly Family Office Data Report: May 2021

Global family office developments continue to transform the operational methods of those within the alternative investment industry and private capital markets. To showcase this model of growth and development, we have compiled a complete breakdown of all single and multi-family office data compiled from May 2021.

Key Figures

- → New Family Office Data Points: 6,750+

- → Total Additions: 670+

- → Updated Family Office Entities: 760+

- → Total Family Office Assets Added: $11B+

- → Newly Tracked Investments: 550+

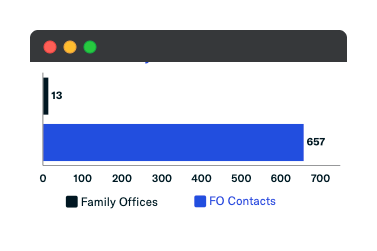

Family Office Additions

Each month, the FINTRX data platform adds and updates hundreds of family offices and family office contacts. Below, we provide a breakdown of all new and updated data points from May 2021.

Total Additions: 670+

⇒ Family Offices Added: 13

⇒ Family Office Contacts Added: 657

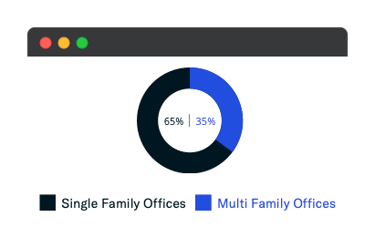

Single Family Office vs Multi-Family Office Breakdown

Of the new family offices added to the FINTRX platform in May, 65% are single-family offices and 35% are multi-family offices.

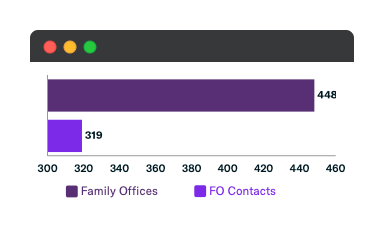

Updated Family Office Entities

Updated Entities: 760+

⇒ Updated Family Offices: 448+

⇒ Updated Family Office Contacts: 319+

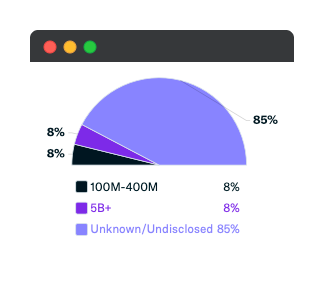

Assets Under Management Breakdown

The chart above shows a breakdown of data regarding the assets under management of the new family offices added in May. Although 85% of new family offices did not disclose their AUM, 8% recorded having $100M-$400M in assets under management, while 8% have $5B+ or more.

The chart above shows a breakdown of data regarding the assets under management of the new family offices added in May. Although 85% of new family offices did not disclose their AUM, 8% recorded having $100M-$400M in assets under management, while 8% have $5B+ or more.

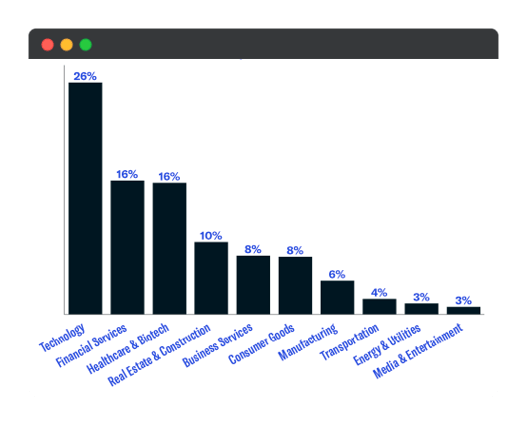

Newly Tracked Family Office Investments: Top 10 Sectors

- 1. Technology = 26%

- 2. Financial Services = 16%

- 3. Healthcare & Biotech = 16%

- 4. Real Estate & Construction = 10%

- 5. Business Services = 8%

- 6. Consumer Goods = 8%

- 7. Manufacturing = 6%

- 8. Transportation = 4%

- 9. Energy & Utilities = 3%

- 10. Media & Entertainment = 3%

Monthly Family Office Data Trend

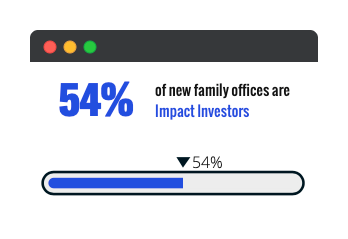

→ 54% of family offices added to the FINTRX platform in May 2021 are impact investors

All FINTRX Data Reports are produced through the utilization of the FINTRX family office data and research platform. Thanks to our dedicated team of researchers - who work every day to add and update our vast dataset - we can share credible information regarding family offices and the private wealth space at large.

With complete coverage of over 3,090+ family offices, 15,800+ family office contacts, and 19,600+ tracked investments, FINTRX ensures direct access to accredited investor intelligence. The FINTRX platform is an essential tool in understanding the family office landscape in the U.S. and abroad, while also empowering users to uncover commonalities with these family offices for effective, personal outreach.

For an in-depth exploration of the FINTRX family office platform, request a demo below.

Written by: Renae Hatcher |

June 11, 2021

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)