START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

2023 FINTRX Family Office & RIA Yearly Roundup

On behalf of FINTRX, the leading Family Office and Registered Investment Advisor (RIA) Data solution, it is our pleasure to share the 2023 Family Office & RIA Yearly Roundup. In this unique newsletter edition, we explore several main themes of the 2023 economic landscape and the broader impact of some of the major events that occurred based on insights from news articles and private wealth narratives featured in our 2023 weekly newsletters. From the Federal Reserve's rate hikes and major bank collapses to the AI investment surge and the looming threat of a 2024 recession, we examine the impact on Alternative Investments, Family Office Investing and RIA Capital Allocation.

Download the PDF

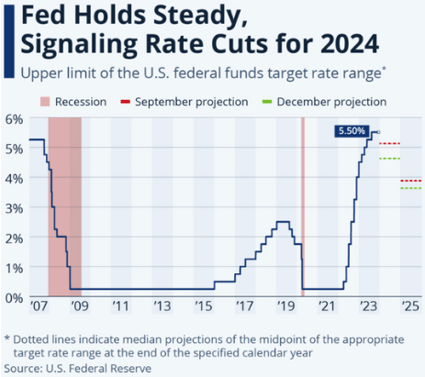

The Fed Slammed on the Brakes

The Federal Reserve's significant interest rate hikes have had a pronounced effect on the world of Alternative Investments. For PE firms, the increased borrowing costs have led to a strategic pivot towards companies with solid cash flows and less dependence on debt financing. VC firms are grappling with the challenge of lower startup valuations due to the heavier discounting of future cash flows, prompting a shift in focus towards startups with more evident paths to profitability.

"Investors remain wary of continued Fed hikes...There’s a lot of negative sentiment and investor psychology reacting to rising rates, and the desire is to sit on the sidelines." - Jeff Klingelhofer, Thornburg Investment Management

Meanwhile, Hedge Funds, particularly those with a macro focus, are navigating this volatile environment by adapting their strategies to exploit the market fluctuations spurred by the Fed's policy changes. While some funds are contending with the altered yield landscape, others are seizing the opportunity to benefit from the prevailing economic uncertainty. This dynamic shift has fundamentally altered the investment approaches within the Alternative Investment sector, as each area responds distinctively to the evolving economic conditions.

Relevant Newsletter Volumes: 41, 46, 56, 60, 71, 73, 75

Click the volume number to read more.

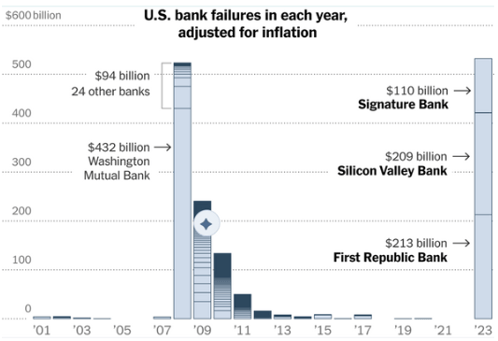

Banking's Bumpy Ride

The banking crisis of 2023, characterized by the fall of major institutions such as Silicon Valley Bank and Signature Bank, reverberated through the investment world, particularly affecting the strategies in family office and RIA spaces. With significant assets of these banks tied up in tech and real estate, family offices, which traditionally invest heavily in these areas, had to swiftly pivot towards more diversified and secure assets. This shift was not just a reactionary measure but a strategic realignment, acknowledging the heightened risks in sectors once deemed stable.

"This is how the system is meant to work. You're never going to have no bank failures." - Jamie Dimon, JP Morgan Chase

Simultaneously, RIAs faced a new set of challenges as they navigated clients through the tumultuous financial landscape. The crisis spurred a deeper focus on alternative investments, as traditional banking and financial stocks became less reliable. RIAs had to balance the need for stability with the pursuit of growth, often turning to less conventional assets that could offer protection against similar future disruptions. This period marked a significant evolution in capital allocation strategies, as both family offices and RIAs adapted to a financial world reshaped by one of the most significant banking crises in recent history.

Relevant Newsletter Volumes: 47, 48, 53, 54

Click the volume number to read more.

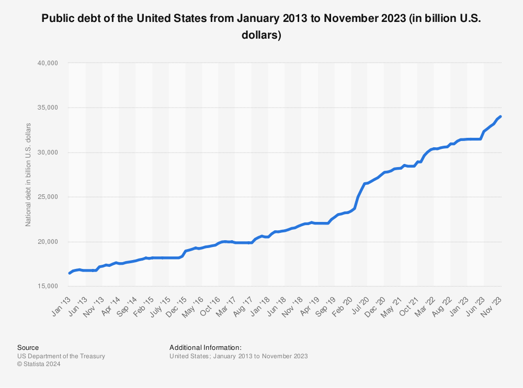

Debt Doomsday Averted, But Barely

The prolonged standoff over raising the U.S. debt ceiling in early 2023 had a direct impact on investment strategies. As Democrats and Republicans locked horns over the debt ceiling, the ensuing uncertainty created a challenging environment for asset managers. This political deadlock, leading up to the critical June 5th “X date” when the Treasury’s emergency cash reserves were expected to run out, forced investors to reconsider their short-term investment strategies.

In anticipation of potential economic fallout, RIAs found themselves advising clients towards more liquidity and risk-averse positions. The fear of a possible default or credit downgrade for U.S. treasuries, traditionally a safe investment, led to a careful re-evaluation of asset allocations. Moreover, the political impasse highlighted the importance of incorporating political risk into investment decision-making, a factor that RIAs, focusing on economic and financial indicators, might have previously underweighted. The scenario demonstrated the need for RIAs to adapt swiftly to external political events, ensuring client portfolios were shielded from large-scale political uncertainties, especially in times when stable economic governance was crucial.

Relevant Newsletter Volumes: 46, 54, 58, 78

Click the volume number to read more.

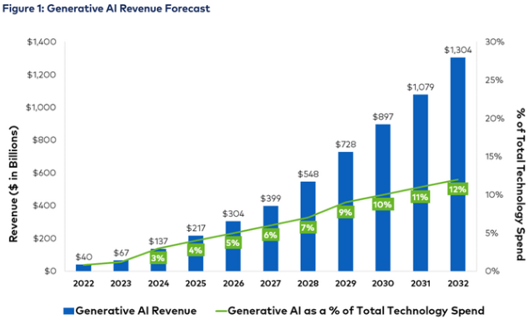

The AI Gold Rush of 2023

The boom of interest in artificial intelligence, particularly driven by developments in ChatGPT and other generative AI technologies, has significantly influenced investment trends within the Alternative Investment space. As major corporations like Microsoft, Google, Amazon, and Nvidia poured billions into AI development, seizing AI startups and seeing their valuations skyrocket, the ripple effects were felt widely. Alternative Investment funds, including Venture Capitalists and Private Equity firms, began aggressively seeking opportunities in the burgeoning AI sector.

"It’s impossible to quantify what the impact of AI could be, and equally possible that a wave of enthusiasm carries stocks with expertise in or exposure to AI, no matter how tenuous, higher and higher..." - Russ Mould, AJ Bell Plc

This gold rush mentality remained eerily reminiscent of the late 1990s "dotcom boom", a time when investors were eager to invest in what is perceived as the next frontier of technological innovation. Venture funds, in particular, have been at the forefront, identifying and investing in promising AI startups, betting on their potential to disrupt various industries. The surge in AI's perceived potential has not only affected the tech sector but has also led to increased valuation and funding rounds for startups centered around AI, as investors look to capitalize on this wave. This movement marks a pivotal shift in the focus of alternative investment strategies, pivoting to leverage the explosive growth and transformative potential of AI technologies.

Relevant Newsletter Volumes: 38, 45, 79

Click the volume number to read more.

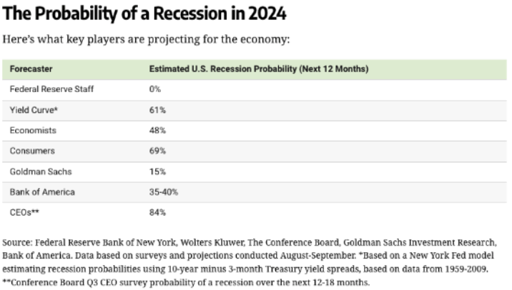

Cloudy With a Chance of Downturn

The shadow of a potential recession looming over the U.S. economy by 2024 has significant implications for the private wealth space. Despite resilient GDP and jobs data, the combination of persistent high inflation, tech sector layoffs, and declining consumer sentiment has heightened concerns about an economic downturn. With most economists and market analysts estimating a 60 to 75 percent chance of recession by mid-2024, portfolio managers are faced with the challenge of steering client portfolios through uncertain waters.

This forecast of economic turbulence has prompted firms to adopt a more cautious approach to capital allocation. Over the past year, there has been an increased emphasis on diversification and risk management, with a focus on assets that can withstand economic downturns or even benefit from them, such as certain fixed-income products or sectors less sensitive to economic cycles. Particularly, RIAs are advising clients to maintain liquidity and flexibility in their investment strategies, enabling quick adjustments in response to changing economic indicators. Furthermore, decision-makers are closely monitoring the impact of Federal Reserve policies and geopolitical tensions on the markets. The need for vigilance and adaptability has never been greater, as professionals navigate the complex interplay of economic, political, and global factors to protect and grow their clients' wealth in a highly unpredictable environment.

Relevant Newsletter Volumes: 55, 59, 82

Click the volume number to read more.

Subscribe to FINTRX's Private Wealth Newsletter

About the Author

We are pleased to introduce the author of the FINTRX Family Office & RIA Roundup, Andrew Popp. Andrew is a member of the FINTRX Data & Research team where he assists in growing and enhancing our vast family office and RIA dataset. With a deep understanding of the private wealth landscape, Andrew provides clients with actionable insights and in-depth market intelligence, arming them with the tools needed to better navigate the private wealth sphere.

member of the FINTRX Data & Research team where he assists in growing and enhancing our vast family office and RIA dataset. With a deep understanding of the private wealth landscape, Andrew provides clients with actionable insights and in-depth market intelligence, arming them with the tools needed to better navigate the private wealth sphere.

To read more about major topics across finance, technology, and regulation in 2023 - from cryptocurrency collapse to inflation spikes to market volatility - access the FINTRX Family Office & RIA Weekly Roundup catalog at any time here. Our archive of newsletter issues from this past year provides in-depth commentary and insights on all of these high-profile stories and trends. Whether you want breakdowns on macroeconomic events, policy changes, M&A deals, or anything impacting private wealth, our newsletter has you covered.

About FINTRX

FINTRX provides comprehensive data intelligence on 850,000+ family office and investment advisor records, each designed to help you identify, access and map the private wealth ecosystem more efficiently and effectively. Explore in-depth dossiers on each family office and investment advisor. Access AUM & account breakdowns, investment preferences & criteria, transaction history, sectors and industries of interest and advisor growth signals, among other key data points.

FINTRX also provides extensive contact information on thousands of key decision-makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, smart bios and much more. Dive into previously hidden personal details & network connections to uncover new business opportunities. FINTRX integrates seamlessly with your day-to-day tech stack and workflow to provide a best-in-class user experience.

Written by: Renae Hatcher |

January 11, 2024

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)