START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Recent Evolutions Across the Family Office Space

The private wealth sphere continues to evolve and expand, with family offices increasingly emerging as influential entities in the investment landscape. With substantial capital at their disposal, family offices have sought to diversify their portfolios and explore alternative investment opportunities to achieve long-term growth and wealth preservation. In this white paper, we delve into the dynamics of recent family office alternative investment trends and highlight the evolutions contributing to the success of family offices, with most citing long-term strategies and high allocations to alternatives as the main drivers. Despite challenges, private equity, venture capital, hedge funds, real estate and direct investments continue to play key roles in investment portfolios as family offices navigate an unsteady market environment.

Download the PDF

Introduction

The global economy has experienced significant fluctuations in recent years, with the aftermath of the COVID-19 pandemic continuing to reverberate across industries and markets. While some sectors have rebounded with remarkable vigor, others have faced enduring struggles, prompting investment managers to reassess their strategies. In this shifting economic terrain, family offices have demonstrated an increasing inclination towards alternative investments, seeking assets that can provide diversification, higher returns, and lower correlations to traditional markets.

One of the key driving factors behind the adoption of alternative investments by family offices has been the persistent specter of inflation. Rising prices, coupled with supply chain disruptions and labor market challenges, have created an environment of uncertainty and heightened volatility. In response, family offices have turned to alternatives to hedge against inflation, aiming to preserve the real value of their assets. As the investment landscape continues to evolve, family offices will undoubtedly play a pivotal role in shaping the trajectory of alternative investments, steering their portfolios towards sustained prosperity and resilience.

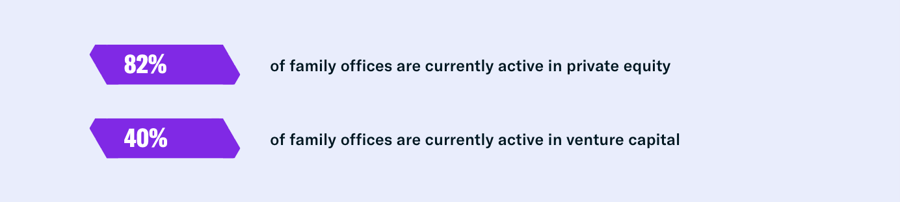

Private Equity & Venture Capital Exposure

Both private equity and venture capital have always been a go-to for investment advisors, offering high potential for substantial returns and direct influence over operations and strategic decisions for privately-held companies. While the two often go hand-in-hand, private equity remains the overwhelmingly favored asset class for family offices, with over 80% of firms actively considering PE investments.

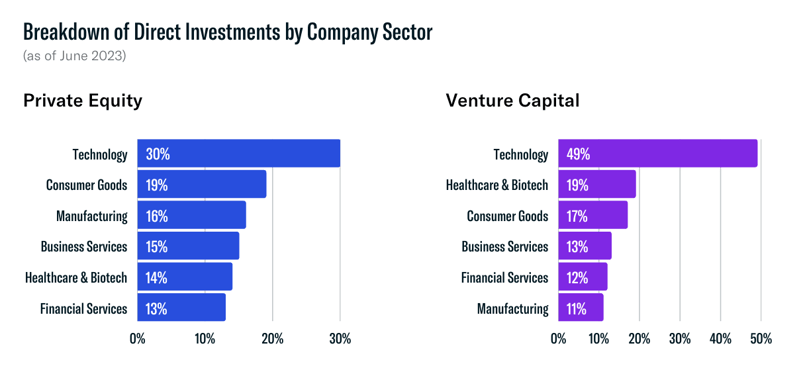

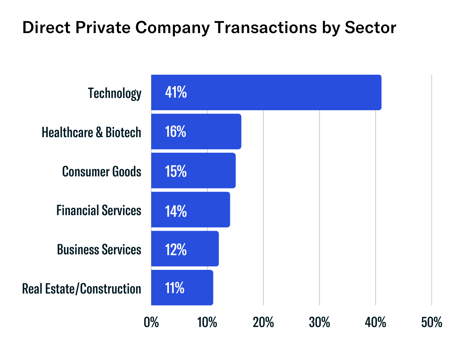

Technology is the dominant industry for both private equity and venture capital investments, making up over 49% of all venture stage transactions. Economic uncertainty poses opportunities for disruption in the market by innovative companies willing to take risks and push boundaries. By investing in these early-stage companies, family offices gain exposure to cutting-edge innovation and the ability to shape the trajectory of industries poised for significant growth.

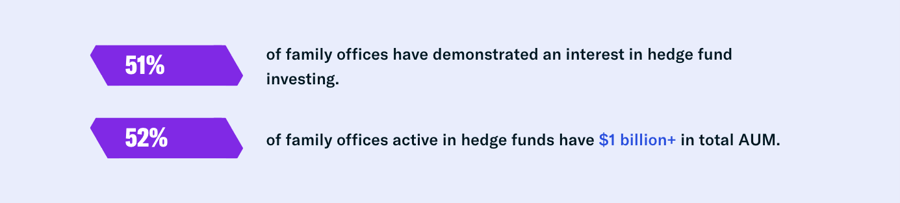

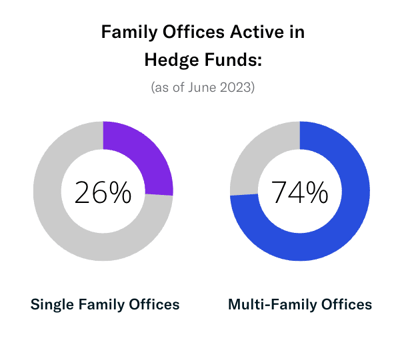

Shifts in Hedge Fund Appeal

Hedge fund investing has experienced a shift in popularity among family offices in recent times. While hedge funds have lost some of their appeal, family offices still recognize their potential for high returns and risk mitigation. In light of evolving market dynamics, family offices have favored other alternative strategies such as direct investments and private equity, however, hedge funds continue to serve as a valuable tool for diversifying portfolios and protecting against market volatility. As the investment landscape evolves, family offices continue to utilize hedge funds for their ability to employ flexible investment strategies and capitalize on market inefficiencies.

Hedge Fund Pulse Check:

+ Interest in hedge funds has decreased among family offices since 2020 as firms turn to other, better-performing alternatives

+ Most family offices active in hedge funds have their wealth origins in entrepreneurship and investment management

+ Hedge funds are significantly more popular with multi-family offices with a high AUM

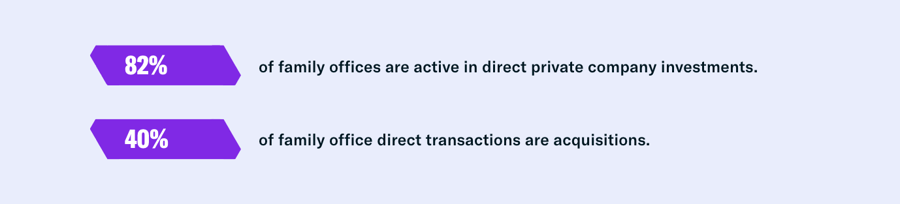

Direct Investment Activity

Although changing demographics and unforeseen turbulence in the markets continue to influence the way family offices manage client wealth, direct investments remain a widespread trend in the family office space. Data shows that family office entities founded in recent years have an increased inclination to invest in opportunities directly, with over half of firms founded after 2016 actively making direct transactions into private companies.

This phenomenon is likely attributed to several factors, including the confidence of self-made entrepreneurs in their ability to effectively identify quality investment opportunities. Family offices whose founders and decision-makers have personal experience in successfully operating and growing businesses are well-positioned to identify quality opportunities.

Why Direct Investments?

Direct Investments Offer:

+ Greater control over investments & management decisions

+ Access to niche investment opportunities

+ Potential for higher returns

+ An outlet to apply industry knowledge

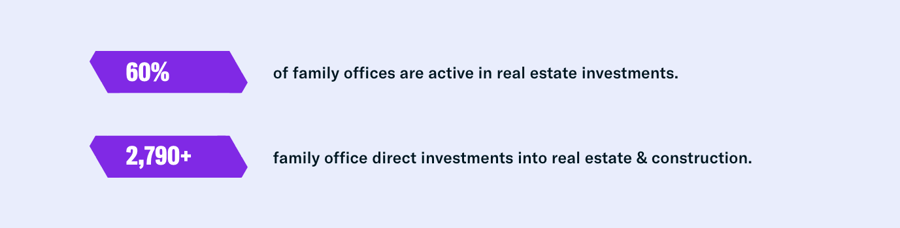

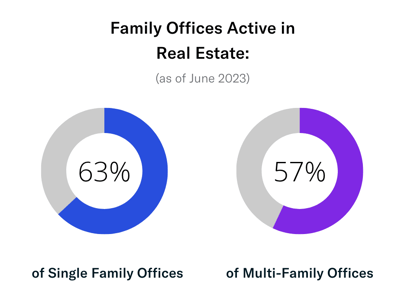

Sustained Real Estate Exposure

Real Estate remains a key asset class for family offices...

Real estate is typically at the center of any strategic review and represents an increasingly important asset class for family offices as it presents the unique opportunity to continuously generate stable cash flow. Real estate investing offers the potential to earn significant returns and add meaningful diversification to your portfolio, even in turbulent markets. Many family offices will leverage real estate investments for the transfer of assets across generations and its appreciation predictability. We continue to see family offices favor real estate in their investment portfolios.

Benefits of Real Estate Investing

+ Offers portfolio diversification

+ High potential for long-term appreciation

+ Steady cash flow and inflation hedging

+ Opportunities for potential tax benefits

Conclusion

Key Takeaways:

+ Economic uncertainty reinforces the need for diversification.

+ Inflationary pressures encourage investments in alternatives to preserve the real value of assets.

+ Private equity is the most popular alternative asset class among family offices, followed by direct investments and real estate.

+ Family offices continue to focus on long-term strategies to weather short-term economic fluctuations.

Family offices have adapted their investment strategies in recent years to navigate the evolving economic and inflationary landscape. Faced with uncertainties and the specter of inflation, these sophisticated investors have increasingly turned to alternative investments to diversify their portfolios, achieve higher returns, and preserve wealth. The exploration of direct investments, private equity, venture capital, hedge funds, and real estate has provided family offices with opportunities to harness growth potential, influence strategic decisions, and mitigate inflationary risks.

About FINTRX

FINTRX is a leading family office & registered investment advisor (RIA) data intelligence solution that provides comprehensive and reliable data on over 3,700+ family offices, 20,000 family office contacts, 40,000 RIAs and 850,000 registered reps. Our financial database combines data, analytics and intuitive software to help clients identify potential investment opportunities, connect with investors and stay informed on industry trends and developments. FINTRX is designed to be user-friendly and easy to navigate, with a variety of features including custom list building, news alerts and notifications, real-time updates and customizable reporting options.

To learn more about FINTRX and request a demo, click below:

Written by: Emery Blackwelder |

June 16, 2023

Sr. Product Marketing Associate at FINTRX

Similar Content

COMPANY

COMPARE US

FROM THE BLOG

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)