START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Maximize Returns: Making Data-Driven Investment Decisions with FINTRX

In today's complex and ever-changing investment landscape, making data-driven investment decisions has become increasingly important. FINTRX - the leader in family office & registered investment advisor (RIA) data intelligence - plays a critical role in helping individuals and organizations make data-driven investment decisions by providing seamless access to accurate and reliable data on family offices, RIAs and the private wealth landscape at large.

Maximize Returns: Making Data-Driven Investment Decisions with FINTRX

Data-driven investment decisions are essential for maximizing returns because they allow investors to make informed choices based on analysis of market trends, economic indicators and other relevant data. With access to accurate and reliable data, investors can identify opportunities, manage risk and optimize their portfolios for better performance as well as reduce reliance on intuition or emotion-based decision-making, which can be prone to biases and errors. Leveraging objective, data-driven analysis empowers industry professionals to uncover trends and opportunities that may not be apparent through traditional means.

Utilizing data to drive investment decisions can also help manage risk by providing insights into market dynamics and potential threats to investor portfolios. By analyzing historical data, asset-raising professionals can identify patterns and correlations that may indicate future market downturns or other risks and take steps to mitigate them. Working alongside data and technology platforms such as FINTRX, investors can remain at the forefront of market trends, spot potential opportunities and enhance their portfolio performance.

FINTRX Overview

FINTRX is a leading family office and registered investment advisor (RIA) data intelligence solution designed to help investment professionals identify and access potential investment opportunities. With access to 3,700+ family offices, 20,000 family office contacts, 37,000 registered investment advisors and 850,000 registered RIA reps, FINTRX offers the most comprehensive family office and RIA data available in the market.

FINTRX features include advanced search filters, investment history and performance metrics, industry insights and news, customized investment recommendations, and integration options with popular CRMs such as Salesforce, HubSpot, Snowflake and more. By leveraging its powerful data tools, investment professionals can make informed, data-driven investment decisions. Plus, FINTRX's data accuracy and verification process ensures updated and reliable information, further increasing the likelihood of success.

Access to Comprehensive Family Office, RIA & Broker Dealer Data

FINTRX offers comprehensive and accurate family office, RIA and broker dealer data intelligence that provides valuable insights into the investment preferences and behaviors of wealthy families and their investment offices. Below are just a few examples of how FINTRX private wealth data can be used to uncover investment trends and opportunities:

1. Identify Emerging Investment Themes: Spot emerging investment trends of family offices and registered investment advisors. For instance, increased investments in renewable energy or healthcare tech could signal a growing trend.

2. Understand Regional Investment Patterns: With information on where family offices and RIAs are investing and why, users can easily identify potential investment opportunities or regions that may be underserved.

3. Analyze Co-Investment Opportunities: Family offices often co-invest in deals with other family offices or institutional investors. By analyzing co-investment data, you can pinpoint potential investment partners and opportunities.

4. Analyze Market Share: RIA and broker-dealer data can be used to examine market share in specific regions or industries. By understanding which firms are dominating the market, you can then identify potential competitors or partners.

5. Identify Family Office Leaders & Top Performing RIA Firms: Pinpoint the most dynamic and impactful firms and individuals in a specific area or sector to facilitate the cultivation of relationships with crucial stakeholders within the private wealth space.

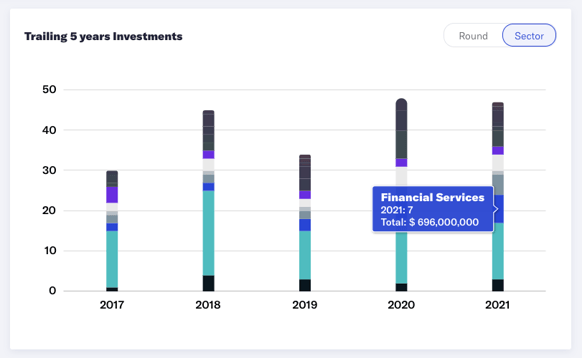

Analyzing Family Office & RIA Investment History

FINTRX provides access to family office and RIA investment history and performance metrics through its comprehensive database of information on single and multi-family offices, private companies, registered investment advisors. The expansive data platform offers detailed information on investment history including past investments, exits and returns as well as performance metrics, such as AUM, investment strategy, asset allocation and more, which can be used to evaluate the investment performance of these private wealth entities. Individuals can also track changes in discretionary AUM and accounts, which helps to get a better picture of how family offices and RIAs are evolving and adapting to market conditions.

Using Investment History to Make Smarter Investment Decisions

We provide a few instances below on how capitalizing on the investment track records of family offices and RIAs can notably enrich your investment decision-making process.

1. Identify investment strategies that have been successful in the past. This information can be used to identify potential investment opportunities that align with those strategies and could lead to similar returns.

2. Analyze performance metrics such as AUM, investment strategy and asset allocation to identify patterns and trends. For example, if a particular investment strategy such as real estate or private equity has consistently performed well for a specific family office or RIA, users can use that information to identify other family offices or RIAs that have similar investment strategies and could also be good investment opportunities.

3. Track changes in discretionary AUM and accounts to identify family offices and RIAs that are growing or expanding their investment portfolios. This information can be used to identify potential investment opportunities with these firms as they are likely seeking new investment opportunities to allocate their growing assets.

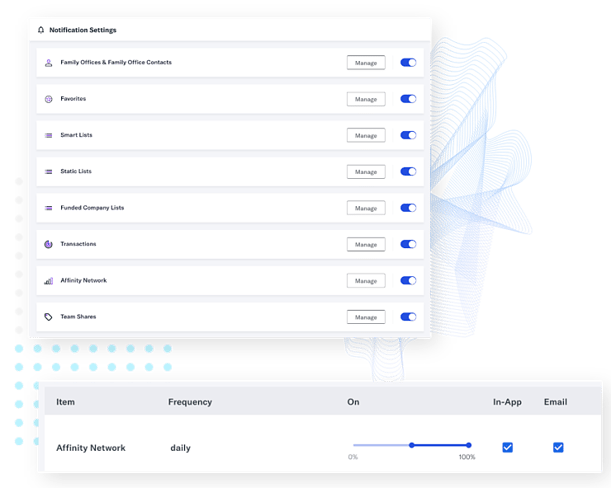

Tracking Industry Trends & News

FINTRX tracks industry trends and news related to family offices, RIAs and the private wealth space at large through its 'Track News Alerts & Notifications' feature. This feature provides users with real-time access to important news and events related to their targeted family offices and RIAs. Users can also set up custom news alerts and notifications to stay up-to-date on specific topics or keywords. This allows individuals to stay informed and engaged with their prospects and clients, as well as to identify potential business opportunities based on specific private wealth developments.

How Industry Trends & News Can Be Used to Make Smart Investment Decisions

Industry trends and news can be valuable sources of information for investors looking to make informed investment decisions. Here are a few examples of how industry trends and news can be used to inform investment decisions:

1. Analyze Industry Trends: By analyzing industry trends, investors can identify areas of growth and potential investment opportunities. For example, if the technology industry is experiencing rapid growth, investors may want to consider investing in technology companies or funds that have exposure to the sector.

2. Monitor Regulatory Changes: Regulatory changes can have a significant impact on certain industries and companies. For example, if a new law is passed that limits the use of fossil fuels, investors may want to avoid investing in companies that rely heavily on oil and gas production.

3. Keep Track of Company Earnings: Company earnings reports can provide valuable insights into a company's financial health and potential for growth. By monitoring earnings reports, investors can identify companies that are performing well and have strong growth potential.

4. Watch Market News: Market news can help investors stay informed about macroeconomic factors that may impact their investments. For example, if there is a global recession, investors may want to avoid investing in cyclical industries that are more heavily impacted by economic downturns.

5. Follow Analyst Reports: Analyst reports can provide valuable insights into individual companies and industries.

The insights on industry trends and updates provided by FINTRX can serve as critical resources for those striving to enhance their investment decisions. By maintaining awareness and keeping abreast with the most recent news and trends, investors are better positioned to recognize prospective investment opportunities and avoid potential pitfalls.

The role of FINTRX in making data-driven investment decisions cannot be overstated. By providing seamless access to accurate and reliable private wealth data, FINTRX helps asset-raising professionals make more informed decisions that ultimately minimize risk and maximize returns.

FINTRX is a necessary tool for all asset-raising professionals looking to effectively raise capital in the private wealth space. By providing access to credible family office and investment advisor data, robust search capabilities, valuable insights and analytics, data integrations and personalized customer support, FINTRX ensures a streamlined process for understanding the private wealth ecosystem and raising capital with greater efficiency. Access to FINTRX data is delivered via its award-winning cloud-based platform and fully integrated iOS mobile applications.

Written by: Renae Hatcher |

June 16, 2023

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

FROM THE BLOG

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)