START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Family Offices Investing in Real Estate: White Paper

Family offices have always been an important element of the investment landscape, bringing different perspectives and time horizons compared to other alternative asset classes. Throughout this narrative, we dive into family office trends regarding real estate, specifically highlighting the advantages of investing in the housing market, assets under management breakdown, the origin of wealth breakdown, regional developments and more.

Introduction

The ongoing uncertainty about what the real estate landscape will look like on the other side of the pandemic has left most real estate developers, family office investors and businesses on the sidelines. Even at the highest levels of global real estate, no one knows for sure what will come next. Since the pandemic hit in March 2020, investors have been monitoring many trends and opinions to help determine their investment strategy. Some predicted that most properties would drop in value because of high unemployment and increasing vacancy levels. Others stated rents would decrease and income would suffer as millions lost their jobs. While there is still a high level of uncertainty when we think of the future, we know one thing is for sure, many are following the trends of family offices, venture capital firms and real estate experts to see what their next move will be.

Advantages of Real Estate Investing for Family Offices

Real estate investing is specifically advantageous to family offices for several reasons. Family offices focus on producing long-term returns as opposed to their institutional counterparts. This is likely because of the physical nature of these investments and the families’ comfortability within the market. Not only does real estate offer tangible investments and fruitful returns, but it also provides an avenue to invest responsibly alongside other families to maximize returns.

1. Cash Flow

Investing in real estate is a great way to accumulate wealth over time. Its long-term, steady nature provides comfort to investors knowing they have a reliable source of passive income. Many family offices will leverage real estate investments for transferring assets across generations and the opportunity to generate stable cash flow over the long term.

2. Appreciation

A major benefit of investing in real estate is its appreciation predictability. Unlike most other asset classes, family offices view real estate as a safe haven for capital. With less downside potential than most other forms of investment, real estate provides family offices with a sense of stability, tangibility and comfort.

3. Control

Family offices and individual investors share a common desire for hands-on control of their capital assets. Having the freedom and flexibility to make independent investment decisions based on personal wants and needs makes real estate even more attractive.

4. Benefits the Community

Family office investors are forward thinkers - continuously reevaluating traditional approaches to investing as a means to grow wealth. Real estate provides the opportunity to increase value and benefit the community. This is ever present with the recent advent of opportunity zone investing.

5. Tax Efficiency

When executed properly, real estate investments typically allow for several tax-deferring benefits, making the industry an even more attractive one for family offices and individual investors.

6. Portfolio Diversification

Because of its limited correlation with equity markets, real estate is often seen as a valuable diversifier for family office investors. Adding real estate to a portfolio of diversified assets can lower portfolio volatility, ultimately providing higher returns with reduced risk.

Real estate investments provide the unique opportunity to maximize investment returns with financing - while stocks, bonds and other investments may not allow for the same financing opportunities. There’s an old saying, 'If you want to create wealth, learn from those who have done it before and take advice from those who have been successful.'

For those looking to maintain and grow wealth, real estate is a great place to start.

Real Estate Investments Before, During & After Covid

Because of the pandemic, people are now on the move faster and farther than ever before. A majority of family offices are now looking to diversify their investment portfolios. With a willingness to take on increased risk, private firms are purchasing properties knowing they will give up cash flow in the short term in order to profit over the long term. With the right management team in place, the housing market will generate the cash flow they are used to.

"Outside of work, the pandemic has caused the greatest relocation of any time in American history and this has its own real estate implications which we will not know for some time as it nets out,” says Ryan Freedman, a commercial property developer and co-founder of venture capital firm Alpaca which invests heavily in real estate ‘prop tech’ (property technology)." - Ryan Freedman, Commercial Property Developer & Co-Founder of VC Firm, Alpaca

Family Offices Investing in Real Estate

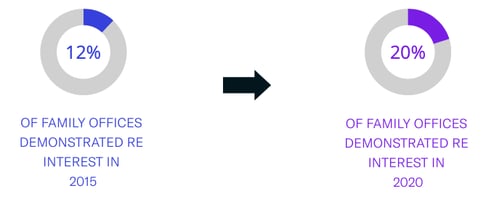

Over the last several years, family offices have been pivoting toward real estate in their investment strategies, and the numbers below mirror the findings. According to the Real Deal, family offices’ share of investments in real estate has grown from 12% in 2015 to 20% in 2020.

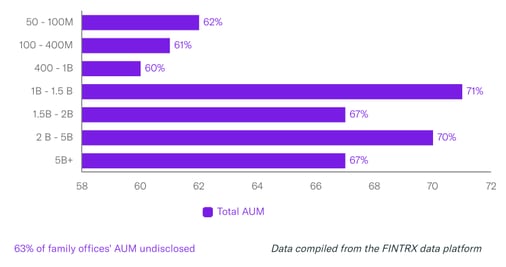

Assets Under Management Breakdown

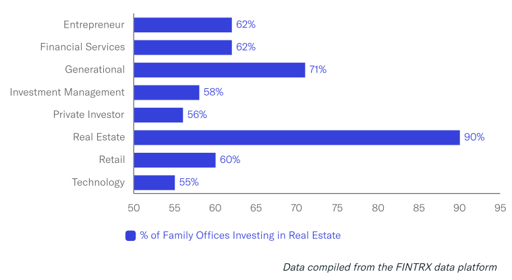

Wealth Origin Breakdown

Family offices, specifically single-family offices, are more likely to allocate capital to industries for which they made their wealth. If you can target capital that can wrap their arms around your proposition and truly understand what you're doing, your hit rate will surely rise.

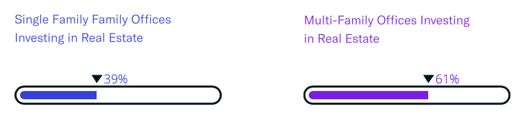

Single Family Office vs. Multi-Family Office Breakdown

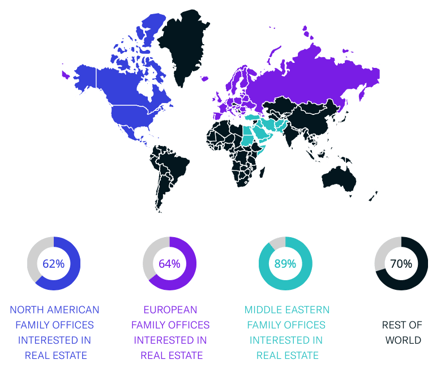

Regional Breakdown

In response to the national crisis, we saw family offices re-balancing their portfolios to maintain long-term strategic asset allocation. According to the 2020 UBS Global Family Office Report, 45% of family offices are planning to raise their allocations to real estate, with a similar percentage aiming to raise allocations in developing markets. While this extends across all continents, those domiciled in North America and Europe show a larger tendency to allocate to the space, as they show a higher inclination to real estate investments internationally. The importance of family offices is rising every day for the real estate markets in the Middle East as well. In the last decade, there has been an increase in the transfer of wealth from corporations to individuals in the region.

According to the research conducted by the Boston Consulting Group, privately owned assets in the Middle East will account for $11.8T by the end of the year 2020, with the UAE, Saudi Arabia and Kuwait accounting for over 22%.

We derived all data from the FINTRX family office & RIA data platform.

Predictions for Real Estate in 2021 & Beyond

The world of real estate and real asset investments is full of uncertainties. To minimize the level of volatilities involved, family offices prioritize investments with intrinsic value and limited downside. On a national scale, however, COVID’s real estate shock waves may prove structurally deeper and longer, but family offices have the resources and teams in place to analyze the different investment opportunities that arise.

"COVID-19 has rapidly accelerated the innovation and adoption of intelligent building and smart home technologies that were already taking hold in the real estate industry,” says Brendan Wallace. “But now thanks to the pandemic most real estate owners feel as if they’ve been thrust five years into the future. As a result, they now recognize that technology adoption isn’t just a ‘nice-to-have’. It’s a necessity. And in the longer-term if real estate owners don’t figure out a strategy to invest in and get access to the technologies that can be strategic to their businesses in a post-COVID world they will soon be, with certainty, on the wrong side of history." - Brendan Wallace, Co-Founder and CEO of Fifth Wall, one of the largest real estate and property tech venture capital firms in the US

However long it takes for us to find our new normal again, we predict real estate will continue to be the main driver of returns for family offices looking to diversify. The other big real estate winner — property tech — is likely to gain attraction as well.

Conclusion

Because family offices seek to make money over the long term, they need a diverse investment strategy in order to do so. Real estate is a key aspect of that diversification as it offers a consistent, reliable source of cash flow, as well as long-term capital appreciation. With the current climate trending toward real estate, more family offices will likely jump on board in the coming years. Forbes Magazine reports:

Although sometimes overlooked in larger portfolios, real estate has grown into a resilient investment and continues to grow in popularity for investors. While family offices share a consistent goal, the manner in which they achieve that goal often takes many forms. Some family offices prefer the hands-off approach of investing through private equity firms - others take a more active role by directly investing in real estate. Both strategies have a track record of yielding successful results. With the uncertainty caused by the pandemic, real estate is experiencing significant re-pricing, and family offices are moving to capitalize on that value. By looking to real estate and avoiding the mistakes of the past, family offices will build resilient investment portfolios for generations to come.

Download Your Copy

FINTRX provides comprehensive data intelligence on 850,000+ family office and investment advisor records, each designed to help you identify, access and map the private wealth ecosystem. Explore in-depth dossiers on each family office and investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors and industries of interest, and advisor growth signals, among other key data points.

FINTRX provides insight and expansive contact information on 850,000+ decision-makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, brief bios and much more.

For an in-depth exploration of the FINTRX family office platform, click below.

For more practical family office insights and best practices, visit the FINTRX 'Resource Library' below.

Written by: Renae Hatcher |

March 22, 2021

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)