START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Family Office Wealth Origin Series: Healthcare

As the leading family office data and research provider, FINTRX continues to see individuals and organizations following similar principles and procedures of family offices. This narrative looks into a specific cross-section of family office entities whose wealth was created in healthcare, offering insight and data into this specific group.

Family Wealth Origin: Healthcare

The family office vertical represents a highly diversified cross-section of the private wealth landscape. Given the private nature of these wealth vehicles, family offices allocate capital with fewer restraints compared to other investment groups. One of the more prevalent patterns drawn from our research is the connection between the industry of wealth origin and the industry of investment interest. As outlined, there is a clear tendency for groups to invest in opportunities throughout familiar industries.

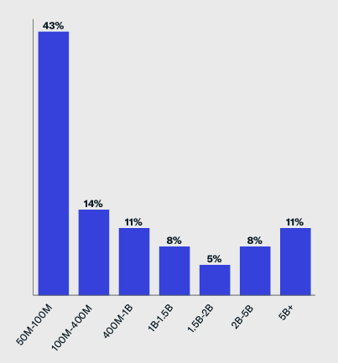

Assets Under Management Breakdown

Family offices allocate significant capital in meaningful ways when provided a suitable opportunity. Below, we outline the assets under management (AUM) breakdown of family offices that have created their wealth in the healthcare industry.

The most prevalent are family offices with AUM between 50 million and 100 million, at 43%. The next largest segment is those with AUM between 100 million and 400 million, at 14%. Insights into the industry in which the family created its wealth can often provide a prediction for their future activities.

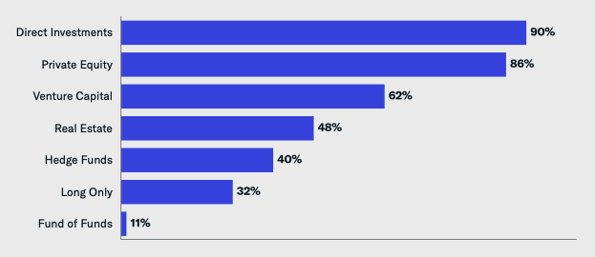

Asset Class Interest Breakdown

Family offices have always been a significant element of the investment landscape, offering different perspectives and time horizons compared to other investment capital sources. From an evaluation and sourcing angle, family offices often prefer investing capital in industries and verticals that they understand - often in areas they created their personal wealth. This stems from a pure understanding of the space and industry connections they possess, which will further add value to the allocation. As outlined below, the largest single group (of family offices with an origin of wealth in healthcare) is making direct investments, at 90%. Next, is private equity and venture capital, at 86% and 62%, respectively.

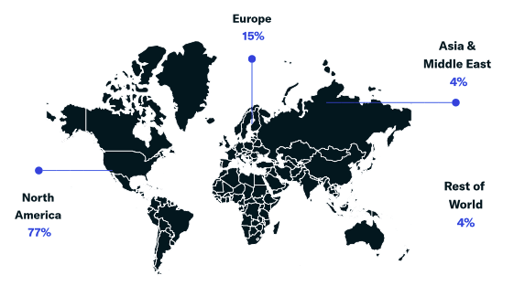

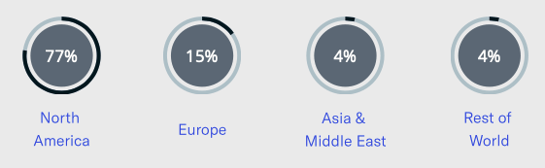

Regional Breakdown

An increase in private wealth has continued to expand the creation of new family offices in areas that were essentially void of these groups in the past. As with industry of wealth origin, the geographic location often plays an important role in the investment preferences of family offices. Our research highlights correlations among the percentages of family offices allocating to certain sectors based on where they are domiciled. Below, you can see a majority of family offices - that have an industry wealth origin in healthcare - are based in North America, at 77%, and Europe, at 15%. The rest of the world makes up the remaining 8%.

An increase in private wealth has continued to expand the creation of new family offices in areas that were essentially void of these groups in the past. As with industry of wealth origin, the geographic location often plays an important role in the investment preferences of family offices. Our research highlights correlations among the percentages of family offices allocating to certain sectors based on where they are domiciled. Below, you can see a majority of family offices - that have an industry wealth origin in healthcare - are based in North America, at 77%, and Europe, at 15%. The rest of the world makes up the remaining 8%.

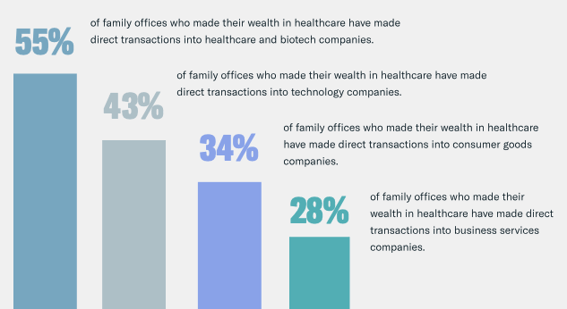

Past Transactions Based on Origin of Wealth

Direct investments have become increasingly common throughout the family office space, particularly within the single-family office ecosystem. We attribute this trend to several changes, none more influential than the increase in sophistication of family offices themselves. Over the past few years especially, we've seen family offices accumulate the assets and skills required to effectively allocate capital directly into the private landscape. The result is more than half of all family offices allocating capital directly to some degree (FINTRX).

Above, we provide a direct investment breakdown of family offices that have an industry origin of wealth in healthcare. As outlined, there is a clear tendency for family offices (with an origin of wealth in healthcare) to allocate capital to healthcare and biotech companies, at 55%. Sectors that follow include technology, at 43%, consumer goods, at 34%, and business services, at 28%.

Conclusion

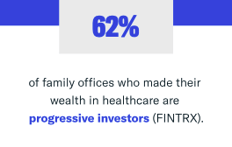

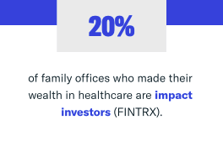

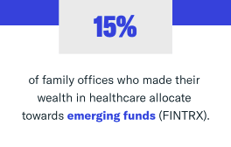

Roughly 6% of the single-family office market comprises family offices that created their wealth in the healthcare industry. This subset of family offices represents more than $55 billion AUM across the globe, with the majority being domiciled in North America. Family offices that made their wealth in the healthcare industry invest progressively and directly, with over half reallocating towards the healthcare sector.

Family offices are opportunistic by nature, as their goal is to preserve and compound capital and identify suitable opportunities to put money to work. Navigating the complex nuances of this highly capitalized pool of capital takes time and patience, but the more you learn and understand, the more likely you are to peel off capital.

All data was derived from the FINTRX family office data and research platform.

Download the full 10-page PDF

The FINTRX family office data and research platform combines over half a million data points on 11,000+ family office professionals and 3,000+ unique family offices globally. Built with the asset-raising professional in mind, FINTRX features state-of-the-art data exploration and visualization tools, engineered to provide the most effective means of targeting family office LPs. The beauty of the above is that all the information our research team gathers is completely proprietary and solely offered by FINTRX. As family offices continue to diversify their investment allocations and advance the scale of their operations, the FINTRX data platform continuously strengthens alongside.

For an in-depth exploration of the FINTRX family office platform, request a demo below.

Written by: Renae Hatcher |

May 03, 2021

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)