START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Family Office Wealth Origin Series: Financial Services

Understanding the reasons behind what makes family offices ideal investors can truly be a game-changer in terms of wealth preservation and wealth expansion. When you consider the structure of family offices and the resources available to them, it's no surprise investors follow their activity so closely. This narrative looks into a specific cross-section of family office entities whose wealth was created in the financial services sector, offering insight and data into this specific group.

Family Wealth Origin: Financial Services

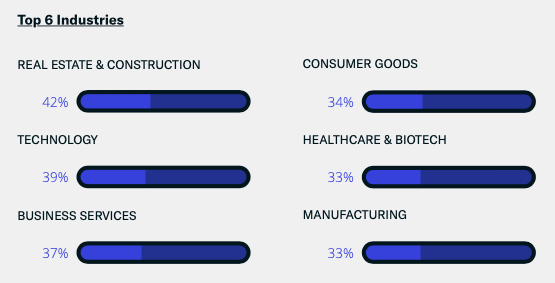

The family office space represents a highly diversified cross-section of the private wealth landscape. Because family offices manage the wealth of such diverse contexts, they operate and invest quite differently from one another. Given the private nature of family offices, these entities allocate capital with fewer restraints in comparison to other investment groups. One of the more prevalent patterns drawn from our research is the connection between the industry of wealth origin and the industry of investment interest. As outlined, there is a clear tendency for groups to invest in opportunities throughout familiar industries.

Family offices are opportunistic by nature and tend to consider a wide range of investment opportunities. Understanding the reasons behind what makes family offices ideal investors can truly be a game-changer in terms of wealth preservation and wealth expansion. When you look at the structure of family offices and the resources available to them, it's no surprise so many investors follow them so closely. What makes following the investment trends of family offices worthwhile is the teams in place that can analyze and essentially vet the different investment opportunities that come their way. Once investment opportunities are vetted, the teams provide advice to the owners of the offices themselves. Despite the obvious challenges it takes to find suitable family office prospects, there are still numerous ways for entrepreneurs and startup companies to drive stronger outreach processes. The more you learn how to navigate the complex nuances of this deep-pocketed pool of capital, the more likely you are to peel off capital.

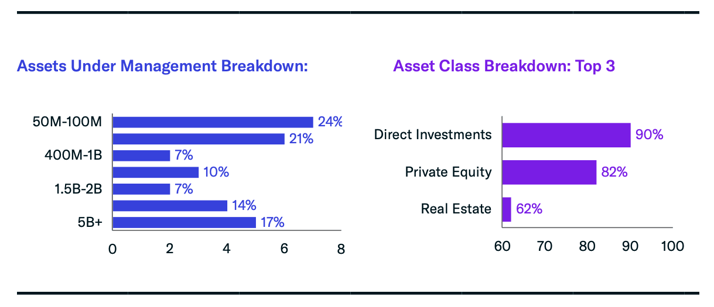

Here you can see a breakdown of family office entities with an origin of wealth in financial services by assets under management and top three asset classes. As outlined in the chart on the left, the greatest number of family offices whose wealth originated in financial services falls between the $50 million and $100 million marks. The chart on the right highlights an outsized exposure of this group making direct private equity transactions. It's important to note, direct investments from family offices that have an industry wealth origin of financial services are more likely to invest directly compared to the total family office market.

Geographic Breakdown

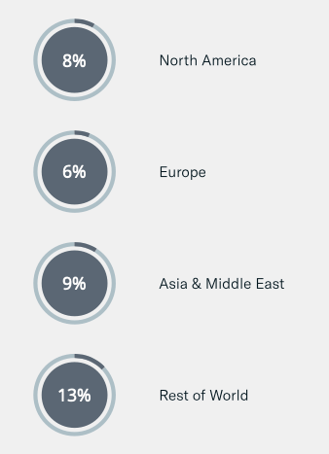

As with the industry of wealth origin, geographic location appears to play a role in the investment preferences of family offices. Research highlights correlations among the percentages of family offices allocating to certain sectors based on where they are domiciled. Below, we have outlined the percentage of family offices in each respective region with an origin of wealth in financial services. The data below shows a propensity of groups (whose origin of wealth is in financial services) to be domiciled in North America (8%) and Europe (6%).

The following data depicts the percentage of family offices whose wealth was created in financial services by region:

Past Direct Investments Based on Origin of Wealth

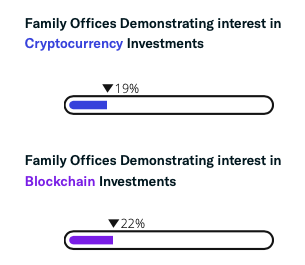

The dramatic rise in mainstream cryptocurrency appeal and its broadening reach to new investor classes is emphasized within the family office space. The family office space can often be seen as a reflective microcosm of the greater financial markets. Cryptocurrency, previously touted as an extremely speculative, poorly understood investment popularized by retail investors, is becoming a more established and attractive investment opportunity for institutional investors and family offices alike.

Family offices who made their wealth in the financial services industry enforced this idea of increased crypto appeal, with 19% demonstrating interest in cryptocurrency investments. Additionally, family offices also expressed 22% interest in blockchain.

All data derived from the FINTRX family office data and research platform. Download the full six-page report below!

The FINTRX family office data and research platform combines over half a million data points on 11,000+ family office professionals and 3,000+ unique family offices globally. Built with the asset-raising professional in mind, FINTRX features state-of-the-art data exploration and visualization tools, engineered to provide the most effective means of targeting family office LPs. The beauty of the above is that all the information our research team gathers is completely proprietary and solely offered by FINTRX. As family offices continue to diversify their investment allocations and advance the scale of their operations, the FINTRX data platform constantly evolves alongside.

For an in-depth exploration of the FINTRX family office platform, click below:

For more practical family office insights and best practices, visit the FINTRX 'Resource Library' below.

Written by: Renae Hatcher |

April 01, 2021

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)