INTRODUCING FINTRX M&A SMARTVIEW

AI-Driven M&A Intelligence To Pinpoint Your Next Deal

M&A Intelligence Tailored To You

AI-powered acquisition scoring, firm targeting criteria, and relationship mapping with your firm’s unique M&A strategy.

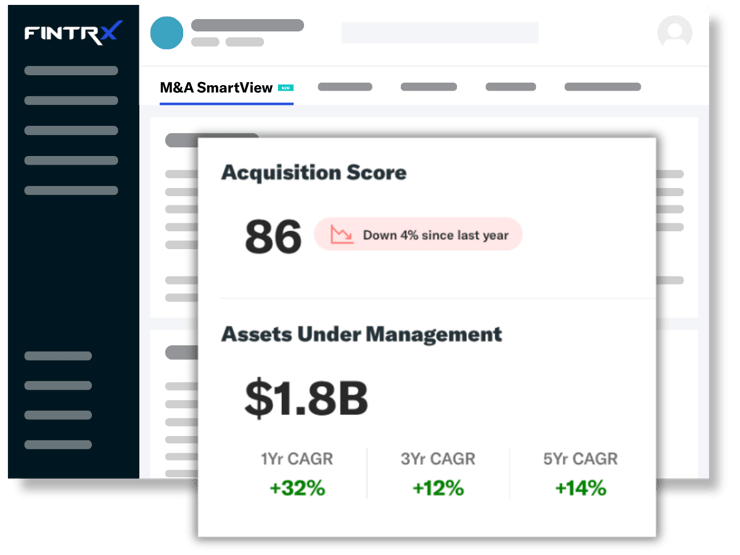

Proprietary Acquisition Score

Quickly prioritize high-fit M&A targets with a proprietary, AI-powered score that evaluates AUM growth, advisor tenure, firm structure, and ownership model—pinpointing firms most likely to transact.

Custom Fit Analysis

Tailor every opportunity to your strategy with AI-driven insights that surface green lights and red flags based on your acquisition goals, rick tolerance, and operational preferences.

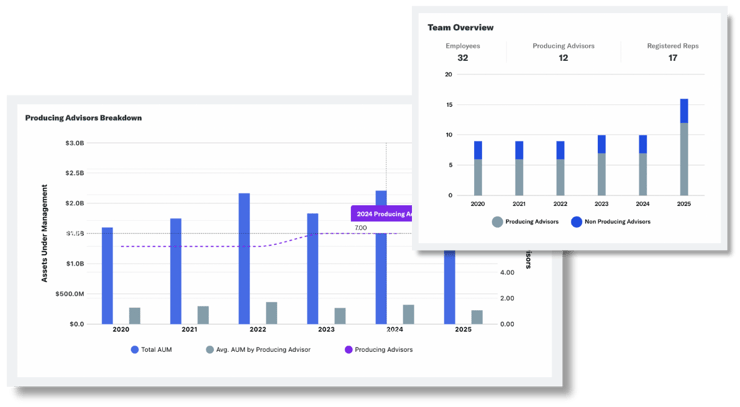

Historical Growth & Team Insights

Access key metrics like AUM trajectory, advisor count trends, and personnel structure to assess scalability, succession planning risk and long-term viability.

Integrated AI Analyst

Evaluate firms in seconds with built-in AI prompts that generate instant analysis on. M&A readiness, historical growth, custodian overlap, and integration potential.

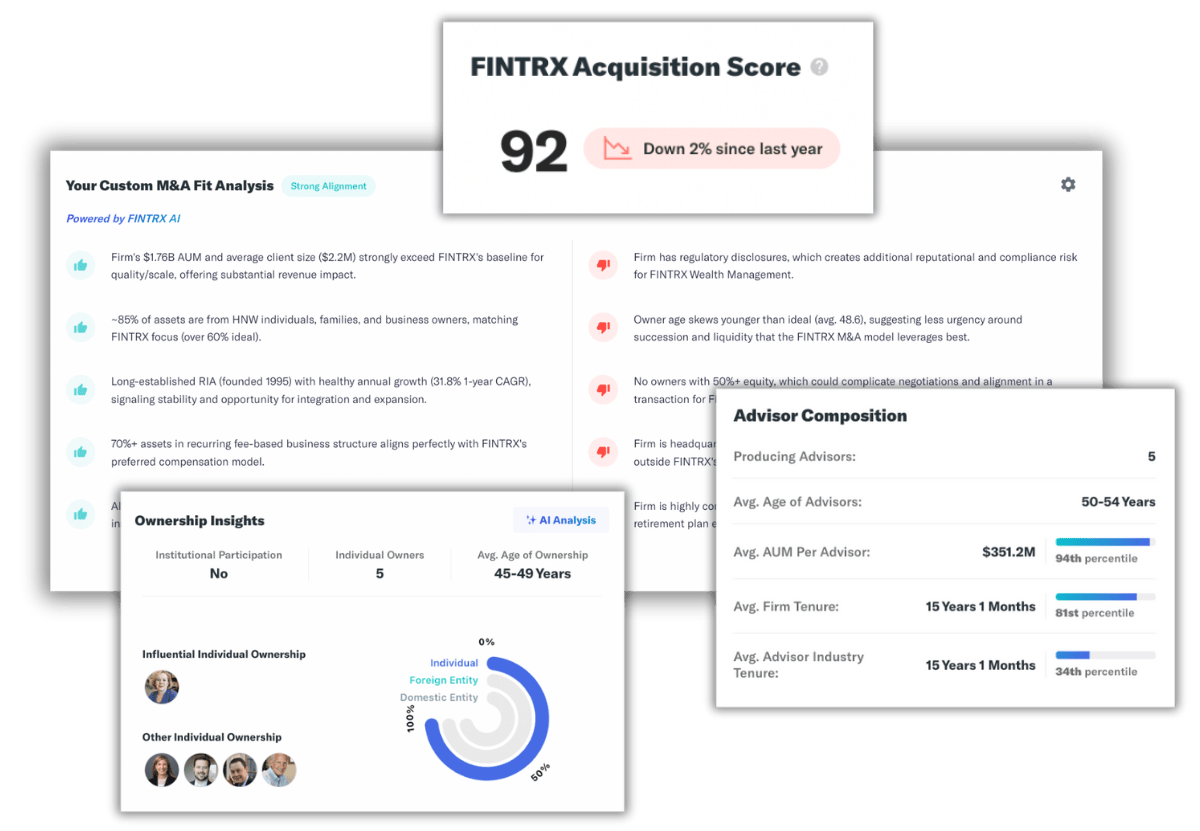

FINTRX ACQUISITION SCORE

Score Targets with Precision

Leverage the FINTRX Acquisition Score to instantly assess which firms are most likely to transact—based on proprietary signals like AUM growth, rep stability, and ownership structure.

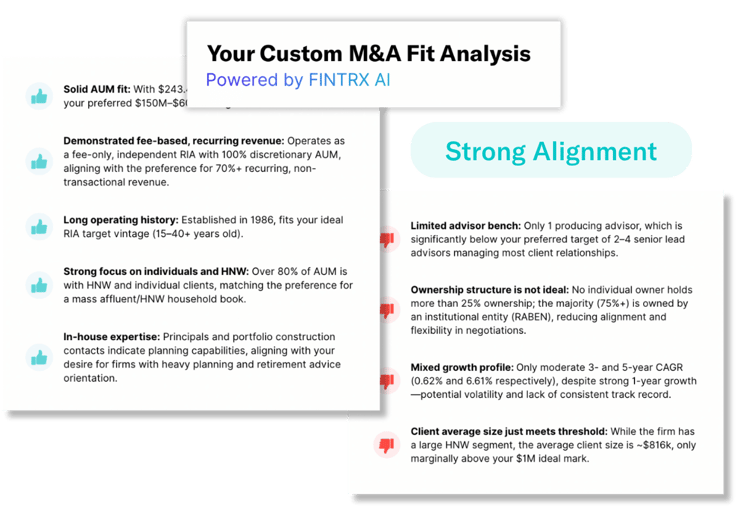

CUSTOM FIT ANALYSIS

Find Your Best-Fit Opportunities

FINTRX SmartView leverages comprehensive data and AI to surface firm-specific green lights and red flags, aligning each prospect to your exact acquisition strategy and preferences.

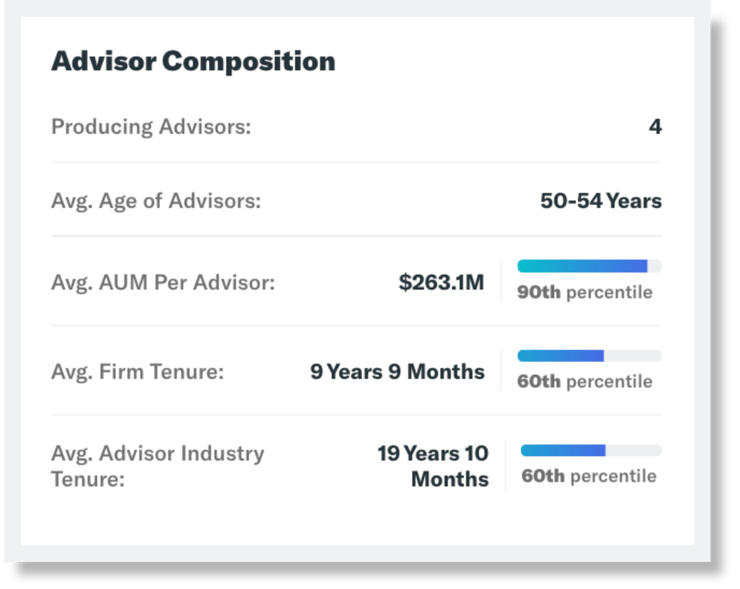

ORG STRUCTURE BREAKDOWN

Evaluate Team Dynamics & Risk

Org Structure Breakdown reveals key decision-makers, advisor tenure, and rep distribution—helping you assess succession planning risk and internal alignment.

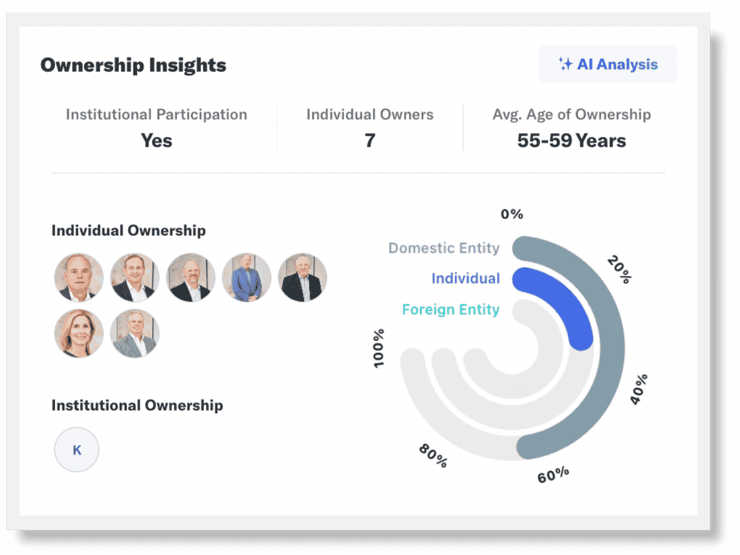

OWNERSHIP MODEL INSIGHTS

Understand Control Before You Engage

Ownership Model Insights uncover whether a firm is independently owned, hybrid, or institutionally backed—vital for assessing deal feasibility and control expectations.

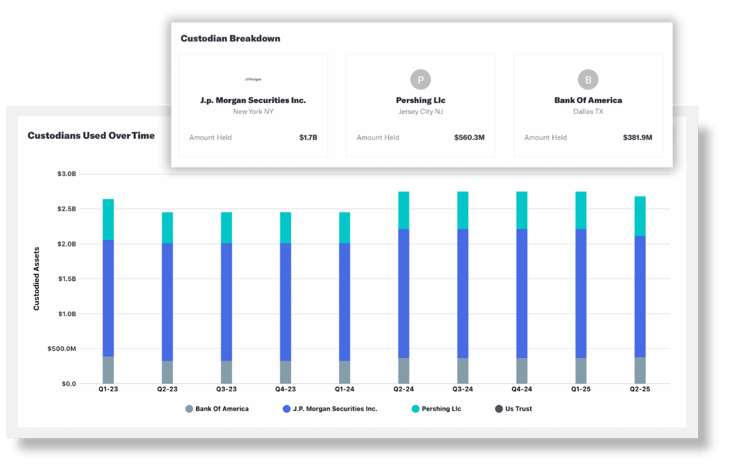

CUSTODIAN DATA

Assess Custodian Compatibility

Custodian Data shows which platforms the firm uses and to what extent—giving you insight into integration complexity and operational fit.

HISTORICAL TRENDS

Spot Scalable Growth Signals

Historical Trends track AUM performance, advisor count shifts, and expansion patterns—highlighting firms with sustainable models and acquisition upside.

Frequently Asked Questions

Can I customize M&A SmartView to match my firm's acquisition strategy?

Yes, SmartView is fully customizable. You can define your acquisition criteria—such as firm size, geographic location, custodial relationships, and rep structure—and receive AI-curated opportunities that align with your specific goals.

How does M&A SmartView determine which firms are acquisition-ready?

M&A SmartView uses the proprietary FINTRX Acquisition Score, which leverages AI to evaluate firm-level indicators such as AUM growth, advisor tenure, ownership structure, and recent activity to surface high-probability acquisition targets.

What kind of firms does M&A SmartView cover?

SmartView covers a broad universe of private wealth firms including RIAs, broker-dealers, and wealth teams—offering deep insight into ownership models, team structures, custodians, and firm performance.

How is FINTRX AI used within SmartView?

FINTRX AI powers key SmartView features, including acquisition scoring, predictive targeting, one-click firm analysis, and Best Path AI, which uncovers warm introductions through your personal and professional network.

Can I integrate SmartView data into my CRM or internal systems?

Yes, FINTRX offers CRM integrations with platforms like Salesforce, HubSpot, Microsoft Dynamics, and DealCloud, as well as API and data feed options for embedding M&A insights directly into your internal workflows.

How often is M&A SmartView data updated?

M&A SmartView is updated in real time, combining AI-driven automation with a 70+ person research team to ensure the most accurate, current, and actionable intelligence on RIA and wealth firm M&A readiness.

total assets tracked

total data points covered

FUNDRAISING

Family Office & Investment Advisor Data Optimized For Fundraising

Access to family office and investment advisor data for fundraising purposes has never been easier. Our intelligent registered investment advisor data is engineered to efficiently deliver comprehensive and accurate data. Using automation, artificial intelligence and our expansive research team, we put real time data in your hands to ensure successful outcomes.

.png?width=220&height=57&name=all%20white%20fintrx%20logo%20(2).png)

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)