START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

October 2019 Family Office Data Report

Hundreds of the world's asset managers, bankers, private businesses and fund managers leverage FINTRX to target family office capital. Blending research, analytics and technology into a single one-stop solution, FINTRX provides further analysis into the many family office data trends our research team has compiled from October of 2019. Continue reading for an in-depth breakdown on how last month unfolded within our ecosystem of 2,620+ family offices, 10,639+ contacts and 3,252+ tracked investments...

CLICK TO VIEW FULL REPORT

October Findings

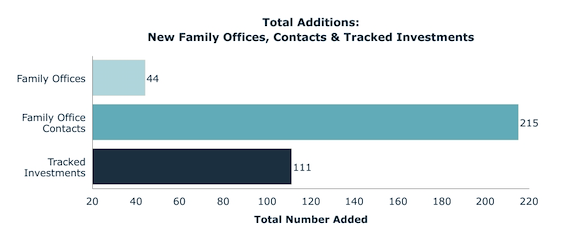

→ Total Additions = 370

- 44 family offices added

- 215 family office contacts added

- 111 family office direct investments added

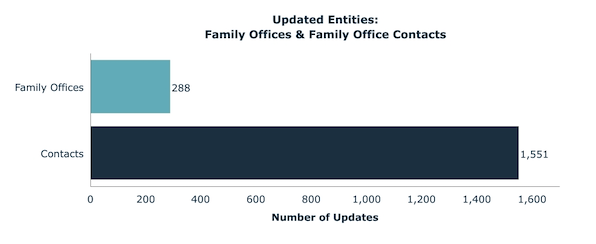

→ Updated Entities

- 288 updated family offices

- 1,551 updated family office contacts

→ New Family Office Data Points = 2,766

→ Total New Family Office Assets Added = $43Billion

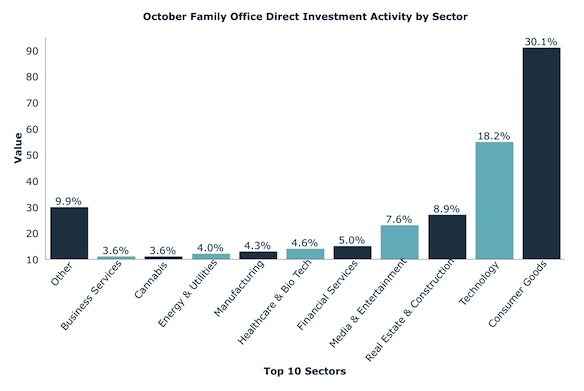

→ October Family Office Direct Investment Activity by Sector

- Consumer Goods = 30%

- Technology = 18%

- Real Estate & Construction = 9%

- Media & Entertainment = 8%

- Financial Services = 5%

- Healthcare & Biotechnology = 4.6%

- Manufacturing = 4.3%

- Energy & Utilities = 4%

- Cannabis = 3.6%

- Business Services = 3.6%

→ Interesting October Trend

- 57% of family offices added in October were Impact Investors

A note from our VP of research...

"As the family office space continues to expand and shift, our research team remains dedicated to providing the most actionable and up to date investor data possible. October echoed similar trends to Q2 with regard to overall family office growth and investment interests. It is worth noting a marked increase in family offices identifying social and environmental impacts as key factors in investment and manager selection. We expect this trend to continue as the average age of family office decision makers decreases…." - Dennis Caulfield, VP of Research

In providing continuously updated family office data, capital raising tools, and savvy search capabilities, FINTRX continues to bring transparency to the family office ecosystem. If you are interested in learning additional information on our proprietary research, please click here.

For an in-depth exploration of FINTRX, request your free trial here:

Written by: Renae Hatcher |

November 06, 2019

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)

-%20(2).jpg?width=3000&name=FINAL-OUTLINE-Monthly-Data-Outline-(Horizontal)-%20(2).jpg)