START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Monthly Family Office Data Report: October 2022

Each month, the FINTRX Family Office and Registered Investment Advisor (RIA) Platform adds and updates hundreds of family offices, family office contacts, tracked investments, and assets to our private wealth dataset. To showcase this model of growth, we have compiled a breakdown of all new and updated family office data from October 2022.

FINTRX Family Office Data Highlights

- - New Family Offices: 63

- - New Family Office Contacts: 333

- - New Family Office Data Points: 3,700+

- - Total Family Office Additions: 680+

- - Newly Tracked Family Office Investments: 280+

- - New Family Office Assets Tracked: $906 Billion

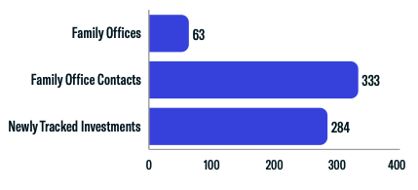

Family Office Additions

Throughout October, the FINTRX Data Research team added 63 new family offices, over 300 family office contacts and 280+ newly tracked investments to our private wealth dataset.

- - New Family Offices: 63

- - New Family Office Contacts: 333

- - Newly Tracked Family Office Investments: 284

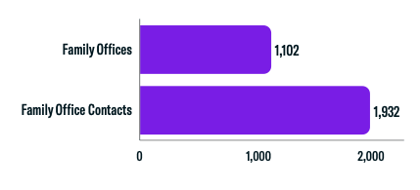

Updated Entities

- - Updated Family Offices: 1,102

- - Updated Family Office Contacts: 1,932

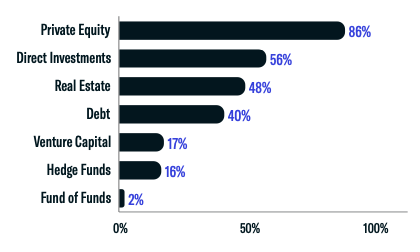

Asset Class Interest Breakdown

- - Private Equity: 86%

- - Direct Investments: 56%

- - Real Estate: 48%

- - Debt: 40%

- - Venture Capital: 17%

- - Hedge Funds: 16%

- - Fund of Funds: 2%

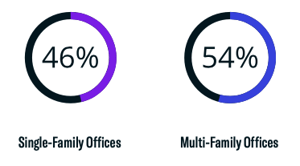

Single-Family Offices vs. Multi-Family Offices

- - Single-Family Offices: 46%

- - Multi-Family Offices: 54%

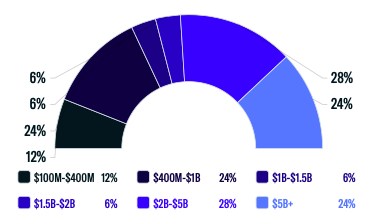

Assets Under Management (AUM) Breakdown

The following chart accounts for all newly added family offices added throughout October that disclosed their assets under management (AUM). A majority of new firms have assets between $2B - $5B, at 28%.

- - $100M-$400M: 12%

- - $400M-$1B: 24%

- - $1B-$1.5B: 6%

- - $1.5B-$2B: 6%

- - $2B-$5B: 28%

- - $5B+: 24%

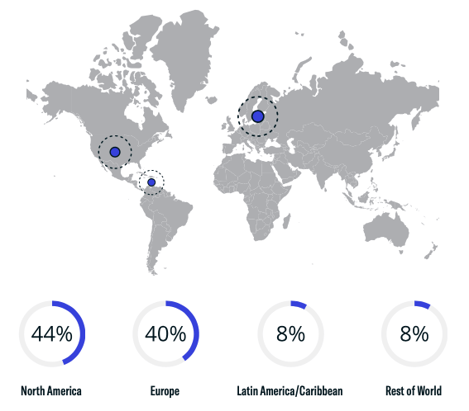

Geographical Breakdown of New Family Offices Added

The chart below displays the geographical breakdown of all new family offices added throughout October. Of the newly added family office entities, 84% are domiciled in North America and Europe.

- - North America: 44%

- - Europe: 40%

- - Latin America/Caribbean: 8%

- - Rest of World: 8%

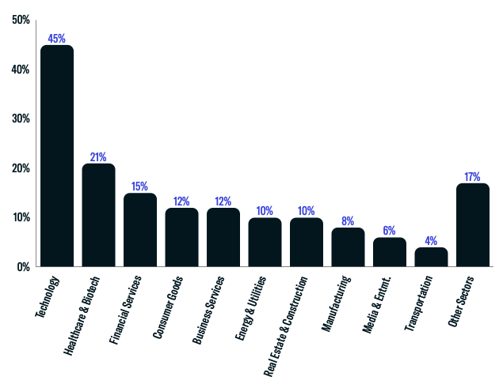

Newly Tracked Family Office Investments

- - Technology: 45%

- - Healthcare & Biotech: 21%

- - Financial Services: 15%

- - Consumer Goods: 12%

- - Business Services: 12%

- - Energy & Utilities: 10%

- - Real Estate & Construction: 10%

- - Manufacturing: 8%

- - Media & Entertainment: 6%

- - Transportation: 4%

- - Other Sectors: 17%

Download the Report

FINTRX provides comprehensive data intelligence on 850,000+ family office & investment advisor records, each designed to help you identify, access, and map the private wealth ecosystem. Explore in-depth dossiers on each family office & investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors & industries of interest and advisor growth signals, among other key data points.

Additionally, FINTRX provides insight and expansive contact information on 850,000+ decision-makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, brief bios & much more.

For an in-depth exploration of the FINTRX family office platform, request a demo below.

Written by: Renae Hatcher |

November 18, 2022

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)