START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

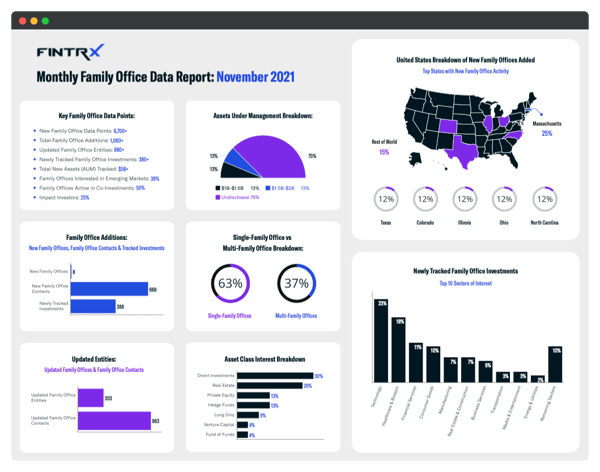

FINTRX Monthly Family Office Data Report: November 2021

Each month, the FINTRX family office data and research team adds and updates hundreds of family offices, key family office contacts, and tracked investments to our rapidly growing family office dataset. To showcase this model of growth, we have compiled a full breakdown of all new and updated family office data from November 2021.

All FINTRX data reports (unless otherwise noted) are compiled through the use of the FINTRX family office data and research platform. Thanks to our growing team of researchers - who work every day to add and update our dataset - we can share credible private wealth intel and growing trends regarding family offices and the alternative wealth landscape at large.

Key Data Points

→ New Family Office Data Points: 6,700+

→ Total Family Office Additions: 1,060+

→ Updated Family Office Entities: 860+

→ Newly Tracked Family Office Investments: 380+

→ Total New Assets Added: $5B+

→ Family Offices Interested in Emerging Markets: 38%

→ Family Offices Active in Co-Investments: 50%

→ Impact Investors: 25%

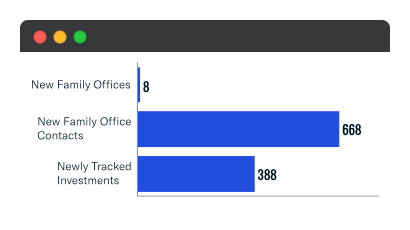

Family Office Platform Additions

Total Additions: 1,060+

⇒ Family Offices Added: 8

⇒ Family Office Contacts Added: 668

⇒ Newly Tracked Investments: 388

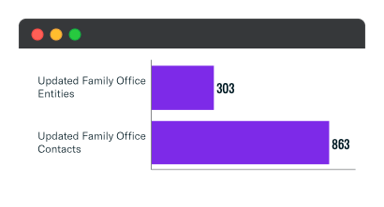

Updated Family Office Entities

Updated Entities: 860+

⇒ Updated Family Offices: 303

⇒ Updated Family Office Contacts: 863

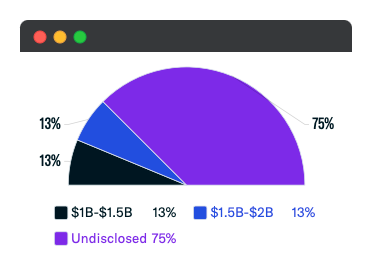

Assets Under Management Breakdown

The data below shows a breakdown of assets under management (AUM) of all new family offices added in November. While 75% of newly added family offices did not disclose their AUM, 13% recorded having assets between $1B-$1.5B, while 13% also recorded having between $1.5B-$2B in AUM.

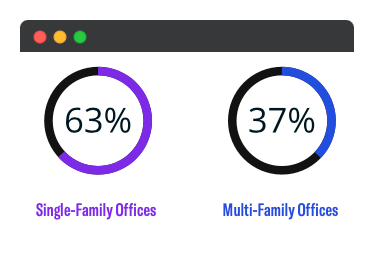

Single-Family Office vs Multi-Family Office Breakdown

Of the new family offices added to the FINTRX platform in November, 63% are single-family offices and 37% are multi-family offices.

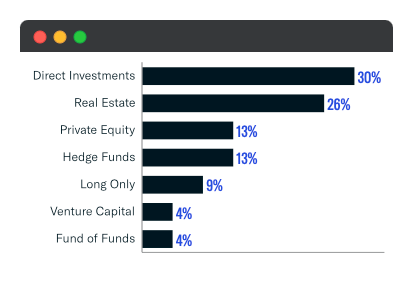

Asset Class Interest Breakdown

A majority of new family offices added to the FINTRX platform last month show a propensity towards direct investments and real estate investments, accounting for 30% and 26%, respectively. Private equity and hedge funds accounted for 13% each, while long-only funds made up 9%. Venture capital and fund of funds each made up 4% (8% total).

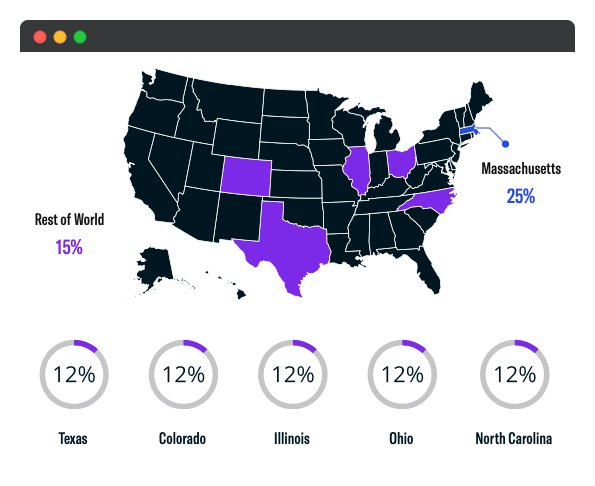

United States Breakdown of New Family Offices Added

Of the new family office entities added to the FINTRX dataset last month, Massachusetts took the lead, accounting for 25% of the newly added wealth vehicles. Texas, Colorado, Illinois, Ohio, and North Carolina each had new family office activity as well, attributing 12% each. The rest of the world made up the remaining 15%.

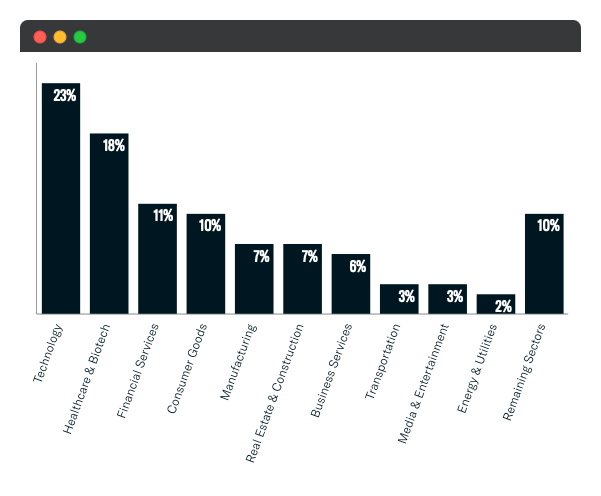

Newly Tracked Family Office Investments: Top 10 Sectors of Interest

- 1. Technology = 23%

- 2. Healthcare & Biotech = 18%

3. Financial Services = 11%

4. Consumer Goods = 10% - 5. Manufacturing = 7%

- 6. Real Estate & Construction = 7%

- 7. Business Services = 6%

- 8. Transportation = 3%

9. Media & Entertainment = 3% - 10. Energy & Utilities = 2%

All other sectors make up the remaining 10%.

FINTRX provides comprehensive intelligence on thousands of private family offices, each designed to facilitate your prospecting and capital-raising efforts. Explore in-depth profiles on each family - AUM, source of wealth, investment criteria, previous investment history, industries of interest - and other key data points to help elevate your workflow. FINTRX offers an inside look at the alternative investment industry and private capital markets.

With complete coverage of over 3,090+ family offices, 15,800+ family office contacts, and 19,600+ tracked investments, FINTRX ensures direct access to accredited investor intelligence. The FINTRX platform is an essential tool in understanding the family office landscape in the U.S. and abroad, while also empowering users to uncover commonalities with these family offices for effective, personal outreach.

For an in-depth exploration of the FINTRX family office platform, click below:

Visit the FINTRX Resource Library below for useful family office narratives, PDFs, and guides to success.

Written by: Renae Hatcher |

December 13, 2021

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)