START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

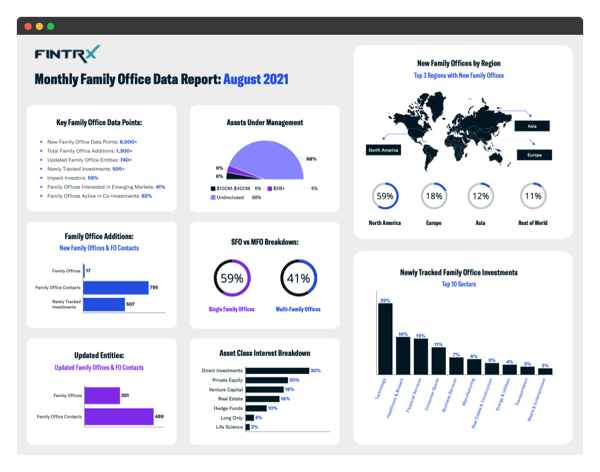

FINTRX Monthly Family Office Data Report: August 2021

Although family offices have been around for some time, we've seen rapid growth in their development over the past decade especially. To showcase this model of growth, FINTRX has compiled a full breakdown of all new and updated family office data compiled from August 2021.

Key Data Points

- → New Family Office Data Points: 8,000+

→ Total Additions: 1,300+

→ Updated Family Office Entities: 740+

→ Newly Tracked Investments: 550+

→ Impact Investors: 59%

→ Family Offices Interested in Emerging Markets: 41%

→ Family Offices Active in Co-Investments: 82%

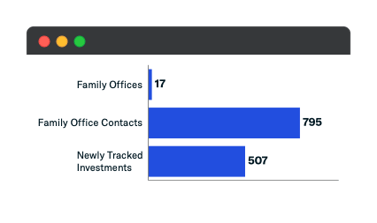

Family Office Platform Additions

Each month, the FINTRX data and research team adds and updates hundreds of family offices and family office contacts. Below, we provide a breakdown of all new and updated data points from August 2021.

Total Additions: 670+

⇒ Family Offices Added: 17

⇒ Family Office Contacts Added: 795

⇒ Newly Tracked Investments: 507

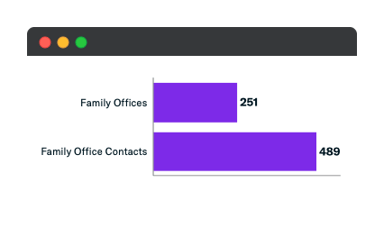

Updated Family Office Entities

Updated Entities: 760+

⇒ Updated Family Offices: 250+

⇒ Updated Family Office Contacts: 480+

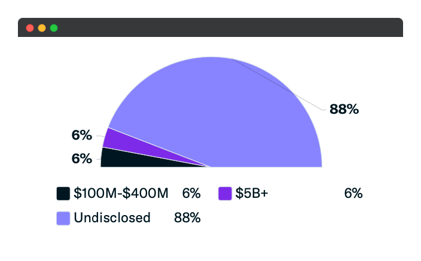

Assets Under Management Breakdown

The data above shows a breakdown of assets under management (AUM) of all new family offices added in August. Although 88% of new family offices did not disclose their AUM, 6% recorded having $100M-$400M in AUM, while 6% have $5B+ or more in assets.

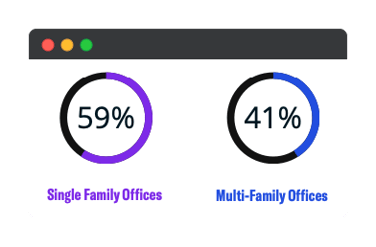

Single-Family Office vs Multi-Family Office Breakdown

Of the new family offices added to the FINTRX platform in May, 59% are single-family offices and 41% are multi-family offices.

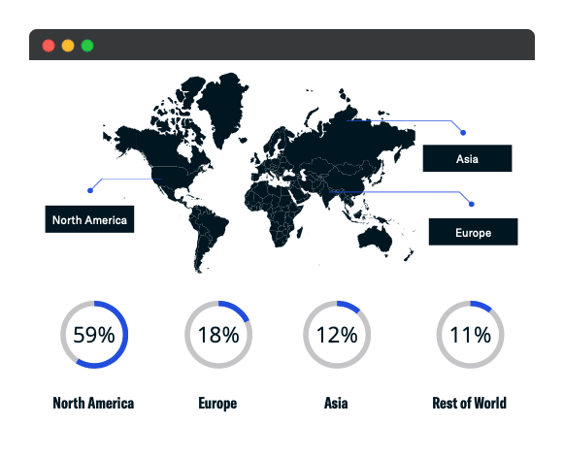

New Family Offices by Region

Of the new family office entities added to the FINTRX platform in August, almost 60% are domiciled in North America, while 18% are based in Europe, and 12% in Asia. The rest of the world makes up the remaining 11%.

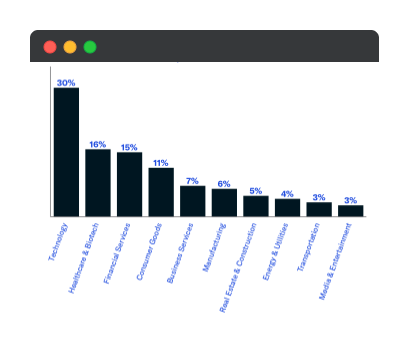

Newly Tracked Family Office Investments: Top 10 Sectors

- 1. Technology = 30%

- 2. Healthcare & Biotech = 16%

3. Financial Services = 15% - 4. Consumer Goods = 11%

- 5. Business Services = 7%

- 6. Manufacturing = 6%

- 7. Real Estate & Construction = 5%

- 8. Energy & Utilities = 4%

- 9. Transportation = 3%

- 10. Media & Entertainment = 3%

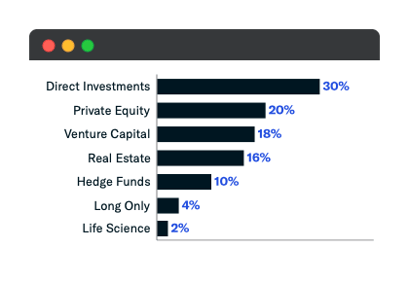

Asset Class Interest Breakdown

A majority of new family offices added to the FINTRX platform in August 2021 demonstrate an interest in making direct investments, with 30% of family offices choosing the direct route.

We produce all data reports through the use of the FINTRX family office data and research platform. Thanks to our growing team of researchers - who work every day to add and update our vast dataset - we can share credible private wealth intel and developing trends regarding family offices and the alternative wealth landscape at large.

Built with the asset-raising professional in mind, FINTRX features intuitive data exploration tools specifically engineered to provide an effective means of targeting family office capital around the globe. Explore full family office profiles with insight on each group, including background, contact information, the origin of wealth, investment interest, investment history, and more.

For an in-depth exploration of the FINTRX family office platform, request a demo below.

Written by: Renae Hatcher |

September 09, 2021

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)