START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

FINTRX Family Office Data Report Q1 2021

FINTRX kicked off Q1 of 2021 by adding and updating hundreds of family office profiles and key contacts within our family office data and research platform. To shine a light on the growing private wealth space, we have constructed a Q1 2021 Family Office Data Report showcasing key family office statistics, notable trends, and further exploration of the alternative wealth landscape. Continue reading for a closer look at how the quarter unfolded within our rapidly growing ecosystem of 3,000+ family offices, and the 11,300+ key decision-makers that work within them.

Message from our VP of Research

In an effort to accelerate the production of asset-raising professionals worldwide, the FINTRX family office data and research platform provides in-depth private wealth intel designed to solve the complex issues industry professionals face daily. Our team members are dedicated, forward-thinking, and constantly striving to enhance the scope and impact of our data. We aim to enhance our clients' outreach process through credible research and state-of-the-art technology. Thank you for taking the time to read through our quarterly briefing and we look forward to a potential engagement with your team.

Introduction

The Q1 2021 Family Office Data Report has been produced exclusively through the use of our expansive family office data and research platform. This cross-section of our complete data set provides an accurate representation of the alternative wealth space and private capital markets, as well as specific family office data trends compiled from January, February, and March 2021. Thanks to our dedicated research team - who continuously update and expand our vast data set - we can share valuable information regarding family offices and the private wealth ecosystem at large.

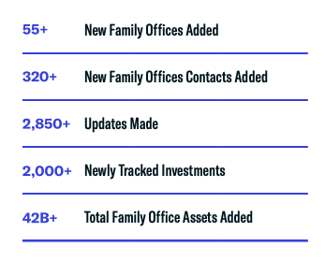

Q1 Data Overview

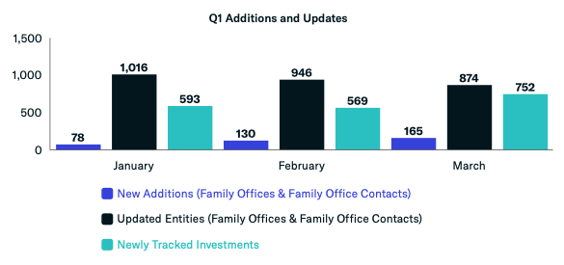

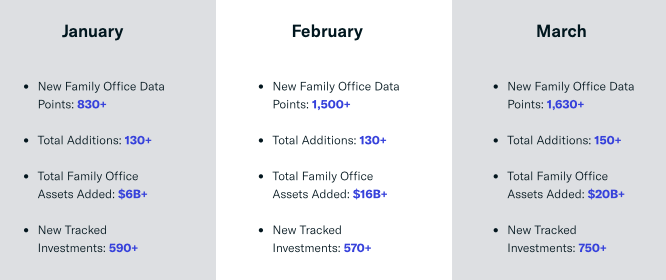

Q1 2021 Additions and Updates

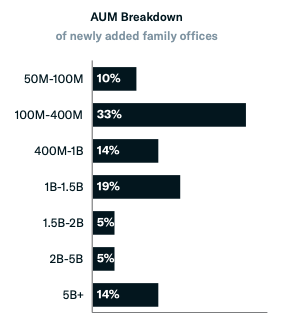

AUM Breakdown (of newly added family offices)

Industry Origin of Wealth (top sectors)

- Financial Services

- Private Investor

- Generational

- Real Estate

Several variables play a part in the investments of family offices. One of the more prevalent patterns elucidated by our research is the connection between the industry of wealth origin and the industry of investment interest. As illustrated above, most family offices added to the FINTRX platform in Q1 made their wealth via financial services, private investments, generational wealth, and real estate.

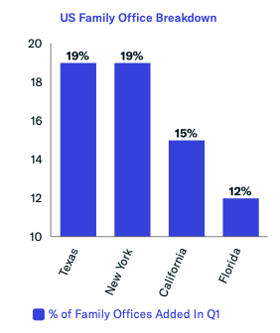

US Family Office Breakdown

Throughout January, February, and March 2021, our analysis showed Texas, New York, California, and Florida as having the most number of family office additions.

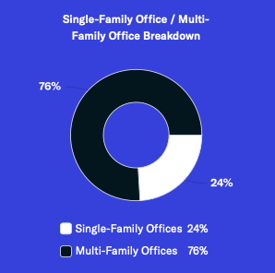

A majority of family offices added are multi-family offices (76%) while single-family office additions made up the remaining 24%.

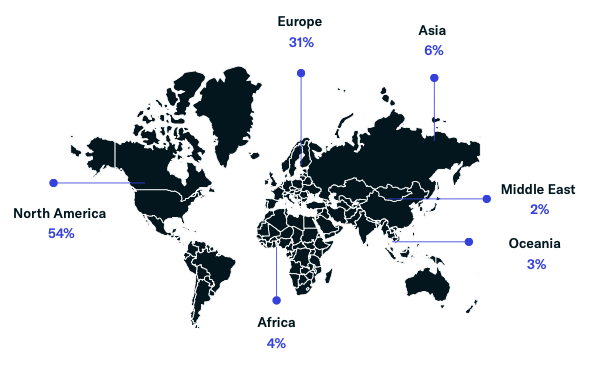

Regional Family Office Breakdown

Top Regions with New Family Office Activity:

- North America: 54%

- Europe: 31%

- Asia: 6%

- Rest of World: 9%

Direct Investment Breakdown

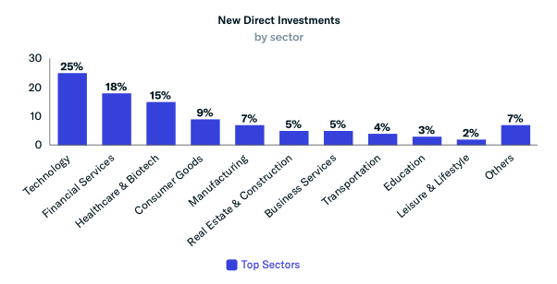

Direct investments have become increasingly common throughout the family office space, particularly when it comes to single-family offices. We attribute this trend to a number of changes, none more influential than the increase in sophistication of family office vehicles themselves.

Over the past decade, family offices have accumulated the assets and talent required to effectively allocate capital directly into the private space. The result is more than half of family offices allocating capital directly to some degree.

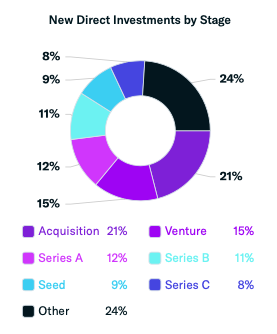

A majority of family offices that made direct investments throughout Q1 did so into the technology, financial services, and healthcare and biotech spaces. 21% of family offices that invested directly did so via acquisitions.

Monthly Breakdown

Conclusion

Parallel to the spike in wealth and family offices being established on behalf of high-net-worth individuals, the FINTRX platform maintains a strong awareness of the market and is consistently enhancing the coverage and impact of its data and research. With their patient capital, family offices are well-positioned to capitalize on many opportunities arising within the current market environment. That said, the family office landscape is an opaque and close-guarded one, which makes our efforts both challenging and rewarding. However, through the expansion of strategic partnerships, private sourcing methods, and public aggregation, we remain dedicated to providing high-quality family office intel to our global client base.

Download the 12-Page Report

FINTRX provides comprehensive intelligence on thousands of private family offices, each designed to facilitate your prospecting and capital-raising efforts. Explore in-depth profiles on each family - AUM, source of wealth, investment criteria, previous investment history, industries of interest - and other key data points to help elevate your workflow.

For an in-depth exploration of the FINTRX family office platform, request a demo below.

Written by: Renae Hatcher |

April 23, 2021

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)