START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Family Offices & Registered Investment Advisors (RIAs): A Comparative Analysis

When it comes to managing wealth and investments for high-net-worth individuals, two of the most popular options are family offices and registered investment advisors (RIAs). Both offer personalized investment advice and management, but there are some key differences between the two. In this blog, we'll provide a comparative analysis of family offices and RIAs, examining their similarities and differences, and exploring the pros and cons of each option. Whether you're a high-net-worth individual looking for investment management services or a financial professional exploring new business opportunities, this blog will provide valuable insights into the world of family offices and RIAs.

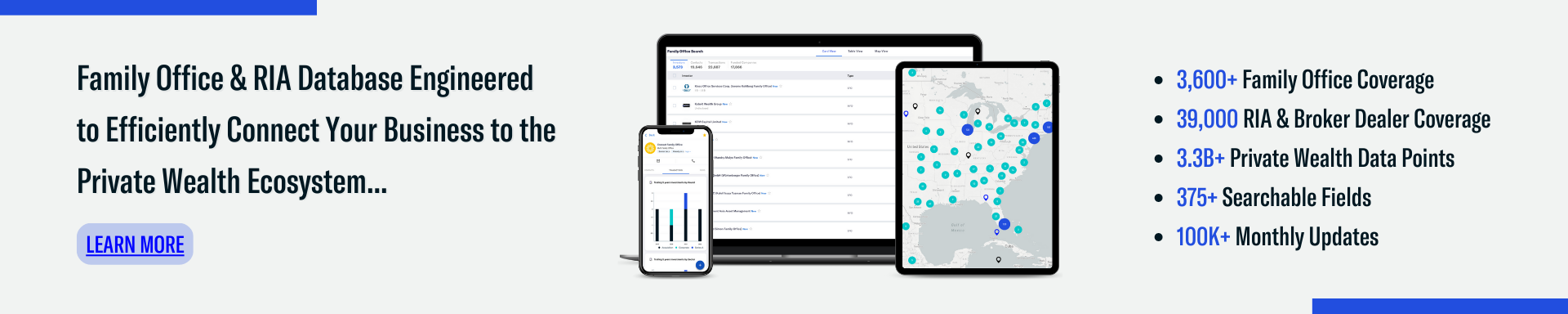

Connect Your Business to the Private Wealth Ecosystem

Looking for a better way to connect your business to the family office & registered investment advisor (RIA) landscapes? Check out our private wealth data offering by clicking the image below.

FINTRX is a leading family office and RIA data intelligence platform that provides valuable insights and information to help users grow their businesses and connect with high-net-worth individuals and institutional investors. FINTRX data covers 3,600+ family offices, 20,000+ family office contacts, 39,500+ registered investment advisor entities and 750,000+ registered RIA reps/contacts. We provide detailed profiles of each family office and RIA, including investment preferences, asset allocation and contact information. Data is sourced from 10+ public & private sources.

Equipped with 375+ search filters, FINTRX allows you to seamlessly track where family office & investment advisor capital is flowing, uncover allocation trends, break down investments by sector & size, understand future investment plans and so much more.

Family Offices & Registered Investment Advisors (RIAs): A Comparative Analysis

Family Offices

Family offices are private wealth management firms that serve high-net-worth individuals and families. They are typically single-family offices (SFOs) that serve single-family or multi-family offices (MFOs) that serve several families. The primary focus of family offices is to manage the wealth and financial affairs of the families they serve. They offer a range of services, including investment management, tax planning, estate planning, and philanthropic services.

One of the main advantages of working with family offices is their ability to make quick investment decisions without the need for approval from outside investors. This allows for a more nimble and responsive investment approach, which can be beneficial for asset-raising professionals. Additionally, family offices often have a longer-term investment horizon and are less likely to engage in short-term trading, which can result in more stable investment returns.

Family offices can offer a more nimble and responsive investment approach, with the ability to make quick investment decisions without the need for approval from outside investors. They also tend to have a longer-term investment horizon, which can result in more stable investment returns. In addition, family offices often have a strong understanding of the families they serve, which can lead to a closer, more personalized relationship between the asset-raising professional and the investor.

Registered Investment Advisors (RIAs)

Registered Investment Advisors (RIAs) on the other hand, are investment advisors that are registered with the Securities & Exchange Commission (SEC) or a state securities regulator. RIAs provide investment advice to clients and are held to a fiduciary standard, meaning they are required to act in the best interests of their clients. Unlike family offices, RIAs often serve a wider range of clients, including individuals, families, and institutions.

One of the biggest advantages of working with RIAs is their regulated status, which provides a level of protection for clients. RIAs are also required to adhere to strict compliance and reporting requirements, which can provide an added level of transparency and accountability. Additionally, RIAs often have a more structured investment process and may be better equipped to manage larger portfolios, making them a good fit for asset-raising professionals seeking a more formal investment process.

RIAs offer a level of protection for clients through their regulated status, as well as strict compliance and reporting requirements. They also tend to have a more structured investment process, which can be beneficial for asset-raising professionals seeking a more formal investment process. Additionally, RIAs may be better equipped to manage larger portfolios, making them a good fit for those seeking to raise larger amounts of capital.

Main Similarities Between Family Offices & RIAs

Investment Management: Both family offices and RIAs specialize in providing investment management services to their clients.

Personalized Service: Family offices and RIAs offer highly personalized service and tailor their investment strategies to each client's unique goals and risk tolerance.

Long-Term Focus: Each private wealth vehicle maintains a long-term investment focus and seeks to build wealth over time through diversified, strategic investment portfolios.

Education & Transparency: Family offices and RIAs prioritize client education and transparency in their investment strategies, ensuring their clients understand the investment decisions being made on their behalf.

Wealth Preservation: Family offices and RIAs both seek to preserve and grow their clients' wealth, often by emphasizing risk management and diversification.

Main Differences Between Family Offices & RIAs

Ownership: Family offices are typically privately owned and managed by a single wealthy family or individual, while RIAs are owned by an independent advisor or advisory firm.

Client Base: When it comes to their client base, family offices often serve a single family, individual or a group of related families and individuals. RIAs tend to serve a broader range of clients including high-net-worth individuals, families and institutions.

Services Offered: Family offices offer a wide range of services beyond investment management, including tax planning, estate planning and philanthropic advising, while RIAs typically focus primarily on investment management and financial planning, among others.

Regulatory Oversight: Family offices are generally not subject to the same regulatory oversight as RIAs. RIAs are registered with the SEC or state securities regulators and must adhere to strict regulatory requirements.

Compensation Structure: Family offices often pay their employees salaries and bonuses, while RIAs typically charge fees based on a percentage of assets under management or commission-based fees.

In summary, family offices and RIAs differ in terms of ownership, client base, services offered, investment minimums, regulatory oversight and compensation structure. Each option has its own advantages and disadvantages, and the choice between the two will depend on the needs and preferences of the individual or family seeking investment management services.

For more on family offices and registered investment advisors, check out our recent blog 'The Intersection of Multi-Family Offices and RIAs'.

Written by: Renae Hatcher |

March 24, 2023

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)