START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Exploring the Registered Investment Adviser (RIA) Channel

The effects of the coronavirus on the global economy continues to reaffirm the importance of strategic planning, operability, client satisfaction and professional development as firms rethink daily work procedures. By focusing on rebuilding and strengthening internal operations, registered investment advisers (RIAs) continue to thrive and gain attraction. In an effort to shine light on the space, FINTRX takes a closer look at the RIA industry at large, offering insight and analytics into how these groups operate.

What is a registered investment adviser (RIA)?

Regulated directly by the Securities and Exchange Commission (SEC), a registered investment adviser - or RIA - is defined as any firm that advises or manages the wealth of high net-worth individuals or institutions. All RIAs are fiduciary organizations and therefore:

→ Have a legal obligation to act in their clients best interest

→ Must be registered with the SEC or their respective state's regulatory body

⇒ SEC has more oversight than the state they are governed in

⇒ 100M+ in assets (AUM) must be registered with the SEC (with few exceptions)

RIAs make up a broad range of groups throughout the financial landscape including wealth advisers, hedge funds, retail investment advisories, private equity firms and a number of other groups that manage institutional capital. Some RIAs may also be registered as family offices, namely multi-family offices, though it depends on the situation at hand.

RIA Fee Structure:

→ Must disclose any and all fees (once registered with the SEC)

→ Compensated by fees charged to their clients

Generally, the more assets a client has, the lower the fee(s). This structure often aligns the best interest of the client with those of the RIA, as the advisers' success is tied with that of their clients.

Services Offered by RIAs (among others):

→ Financial planning

→ Portfolio management

→ Pension consulting

→ Selection of external advisers

→ Publication of periodicals

→ Security ratings

→ Market timing services

→ Asset allocation

→ Educational seminars/workshops

→ Tax planning

→ Estate planning

→ Insurance services

RIA Market Growth

Asset managers and investment advisers have been around forever. But it wasn't until the Investment Advisers Act of 1940, these groups were formally required to register with a governing body. Since then, RIA market growth has been notable, to say the least, with an estimated 35,000+ entities and 405,000+ contacts in operation today, though numbers continue to rise.

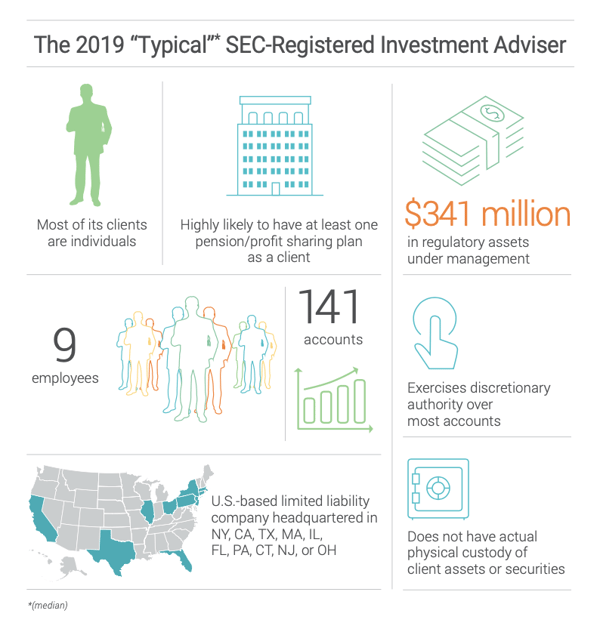

As indicated in the 2015 Evolution Revolution Report, produced simultaneously by the Investment Adviser Association and National Regulatory Services, the number of SEC-registered investment advisory firms totaled 11,473 - a 5.3% net increase from 2014. Over the next several years, numbers continue to demonstrate a healthy increase, overall. Moving ahead, the 2019 Evolution Revolution Report demonstrates the number of SEC-registered investment advisers rose to 12,993, which demonstrates a 3.33% net increase since 2018.

As always, new clients are integral to the growth and development transpiring within the RIA space, with the total number of clients climbing 85% over the past eight years. In 2015, SEC-registered advisers reported approximately 30 million clients, up roughly 6.8% from the previous year. Whereas in 2019, SEC-registered investment advisers reported serving more than 43 million clients, with high net-worth individuals making up 12.3%. This healthy increase emphasizes the continuing health and expansion of the RIA market, at large. In addition to strong client growth, the RIA channel remains a dominant job creator as well, with a reported 835,124 (nonclerical) employees – up 3.7% from a year earlier (2018) and up 16% over the last five years.

As we continue to face the reality of a global pandemic, advancements in the registered investment market show no signs of slowing down any time soon. By focusing on internal operations and other business fundamentals, many RIA firms learn to thrive and grow - even in turbulent markets.

The utilization of our family office data and research platform has opened doors to the many investment trends that shape our global economy. Engineered to help our clients identify and access family office capital in an intuitive and efficient manner, the FINTRX family office platform offers accurate family office data and research, built with a bottom-up approach.

For an in-depth exploration of the FINTRX family office platform, click below:

For more practical family office insights and best practices, visit our 'Resource Library' below.

Written by: Renae Hatcher |

August 27, 2020

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

FROM THE BLOG

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)