START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Breaking Down AI Elements: Build Your Own Custom Intelligence in FINTRX

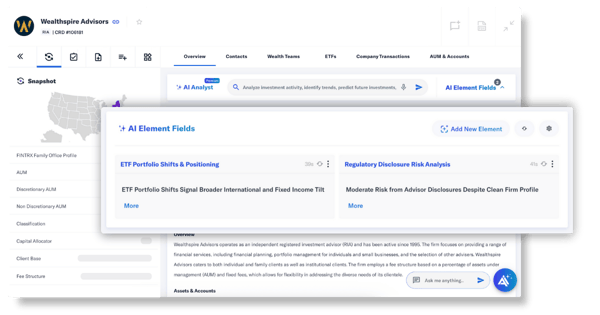

Data is only as valuable as the insight you can extract from it. Traditional data platforms—even comprehensive ones—are inherently static and generic. They give you a fixed set of data fields and metrics to work with, which may or may not align with how you define opportunity, fit, or risk. With the launch of AI Elements, FINTRX eliminates that limitation. AI Elements turns the FINTRX platform into a living, customizable intelligence engine, giving you the power to create, structure, and deploy your own proprietary data fields across RIAs, broker-dealers, family offices, advisor teams, contacts, and more.

What is AI Elements?

AI Elements allows you to easily create fully custom data fields and analysis using natural language prompts. Each Element you build becomes a persistent, searchable, and filterable part of your FINTRX environment, just like a native data field. Think of it as designing your own column in the FINTRX dataset—one that’s automatically populated by AI across thousands of records based on your specifications.

Want to rank RIAs by personalized product fit? Score family offices by alternative allocation potential? Analyze advisors by breakaway risk? Pull hyper-targeted lists of investment decision-makers?

AI Elements does all of this instantly, at scale, and fully integrated into your workflow.

How It Works: The Technical Side

AI Elements uses a simple three-step creation framework that makes it both powerful and intuitive:

1. Define your Element

Decide what type of data or analysis you need, and give your Element a name that reflects the analysis you want to perform, such as 'Product Fit Score', 'Active ETF Portfolio Growth (%)', or 'Breakaway Probability Index'.

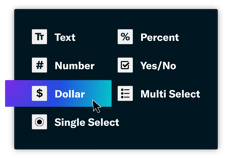

2. Structure your data output

Decide how you want the AI to represent the result. AI Elements supports both qualitative insights and quantitative indicators such as:

• Numbers

• Percentages

• Dollar values

• Free text

• Single or multi-select categories

Each format type influences how your Element appears across profiles, lists, and search filters.

3. Write your AI prompt

This is where the intelligence happens. Simply describe in natural language what you want the AI to assess and generate. For instance:

→ “Analyze each RIA’s custodian relationships, ETF adoption, and AUM breakdown to determine how well they align with mid-cap growth strategies. Return a score from 1–10.”

→ “Calculate the percentage increase/decrease of each firm’s actively-traded ETF book over the last 3 years.”

→ “Scan for CIOs, Heads of Investment Research or portfolio managers and provide the most relevant contact for investment decisions. Include contact information and personal details.”

FINTRX AI then processes your instruction, interprets relevant fields across the dataset, and applies that logic uniformly, creating a consistent, structured output across every applicable record platform-wide.

Integrated Intelligence, Built to Scale

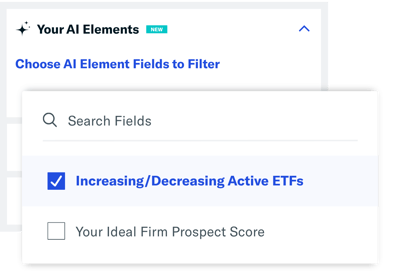

Once created, your AI Elements become persistent and fully integrated across FINTRX. They can be:

• Searched, sorted, and filtered just like FINTRX-native data fields

• Displayed as custom data columns within your lists

• Displayed within firm and contact profiles

That means every Element you create becomes a new lens through which you can view, rank, and engage your total addressable market.

From Static Data to Dynamic Intelligence

Before AI Elements, users worked within a predefined structure. FINTRX provided the data, and while comprehensive, that framework was generic—not fully personalized for each individual user.

AI Elements inverts that model. Now you define the intelligence.

This shift empowers you to build proprietary data models that reflect your strategy, rather than adapting your strategy to someone else’s generic dataset.

Real-World Use Cases

Here’s how different teams are already leveraging AI Elements to transform their workflows:

Distribution and Sales

• Generate personalized product fit scores to prioritize outreach

• Identify which firms are most compatible with your firm’s custodian or distribution partners

• Run detailed portfolio trend analyses

M&A and Advisor Recruiting

• Create a breakaway probability index to target advisors most likely to change affiliations

• Rank potential acquisition targets based on strategic and operational alignment

Asset Raising

• Highlight firms with positive inflows and growing AUM that may be more open to new investments

• Run alternative and direct investment trend analysis

• Generate context-based insights across lists to personalize outreach

The Bigger Picture: Why Does it Matter?

AI Elements represents a fundamental evolution in how FINTRX delivers value. Rather than simply providing a standard database of private wealth firms and professionals, FINTRX now gives you the ability to generate your own intelligence layer on top of that data—instantly, and at scale.

In doing so, FINTRX becomes more than a data platform. It becomes an extension of your analytical brain, capable of building and maintaining proprietary intelligence that’s unique to your business.

You’re no longer just using data, you’re defining it.

The Bottom Line

AI Elements puts the full power of FINTRX data and generative AI in your hands, enabling you to create new insights, proprietary metrics, and competitive advantages that were previously impossible to scale. It’s not just an enhancement to FINTRX, it’s the foundation of a new way to think about data intelligence.

Request a demo today and discover how FINTRX AI can redefine how your firm builds and scales industry intelligence.

Written by: Emery Blackwelder |

October 28, 2025

Sr. Product Marketing Associate at FINTRX

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)