START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Notable Reps On the Move: The Aftermath of the First Republic Bank Collapse

The banking crisis of 2023 hit markets hard in Q1 and Q2 as several large-scale banks collapsed, including San Francisco-based banking giant, First Republic, causing billions of dollars in managed assets to be redistributed across the industry as the bank's financial professionals sought new firms to take their books of business. Fueled by FINTRX data, this piece explores some of the most notable departures of financial advisors and wealth management teams from First Republic Bank, the distribution of their managed assets amongst other industry leaders, and the biggest winners of the most recent large-scale bank collapse.

Click below to access the full PDF report

Background On the Banking Crisis of 2023 and First Republic's Downfall

In March 2023, a series of bank failures sent shockwaves through the financial world. Over the course of five days, three small to mid-size U.S. banks collapsed, causing a rapid decline in the stock prices of banks worldwide. The collapse of Silicon Valley Bank, triggered by a bank run after it incurred substantial losses by selling its Treasury bond portfolio at a loss, created uncertainty and turbulence in the market, setting other financial institutions up for potential losses.

Not long after SVB, another significant casualty of the banking crisis emerged: First Republic Bank, a San Francisco-based firm specializing in private banking for high-net-worth individuals. The bank faced the challenge of a substantial amount of uninsured deposits exceeding $250,000, leaving those balances vulnerable. As the crisis unfolded, depositors became increasingly concerned about the bank's stability, prompting them to withdraw their funds. Despite efforts to stabilize the situation, including a $30 billion capital infusion from major banks, First Republic's stability rapidly declined.

First Republic's credit rating took a major hit when credit agencies highlighted the high proportion of uninsured deposits and a loan-to-deposit ratio that indicated the bank had lent out more money than it had in customer deposits. Withdrawing over $100 billion in uninsured funds, primarily from its high-net-worth clients, further destabilized the bank, and its reliance on municipal bonds limited its access to emergency lending programs.

Eventually, the bank's stock price plunged as investors lost confidence, and the FDIC initiated an auction process to find a buyer for First Republic. Ultimately, JPMorgan Chase acquired First Republic's assets for roughly $10.6 billion, marking the official end of the bank.

The Outcome

In response to the downturn of the bank, First Republic's wealth management teams and financial advisors unsurprisingly began seeking out other firms where they could take their books of business, inevitably leading to billions of dollars in managed client assets departing the firm in favor of competing financial institutions.

The Biggest Winners of the First Republic Bank Collapse

Cresset Asset Management

Headquartered in Chicago, Cresset Asset Management is a rapidly-growing young firm. Founded in 2017 as a multi-family office emphasizing private equity investing, Cresset had already amassed over $25 billion in assets under management prior to 2023 and continues to grow exponentially, having acquired several financial services companies since 2019.

Their big win in the First Republic collapse came in the form of a team--previously known as Constellation Wealth Advisors--that managed over $12 billion in AUM at First Republic. Operating out of Greenwich, CT and Menlo Park, CA, the team brings an impressive book of business to Cresset, promising continued high-level growth for the firm.

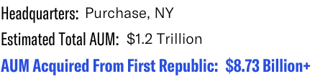

Morgan Stanley

Morgan Stanley has been a preeminent financial services company in the US since its inception in 1935. The firm boasts an impressive $1.2 trillion in assets under management and offers a wide range of services to its clientele, acting as a qualified custodian, wirehouse and investment bank in addition to its wealth management and bank services.

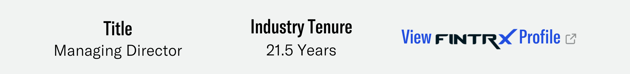

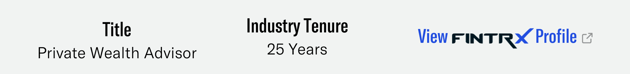

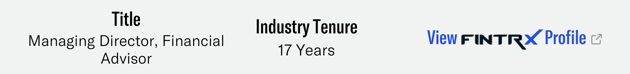

The firm made big moves during First Republic's downfall, pulling in over $8 billion in managed assets from individual advisors and teams. Among the number who made the move to Morgan Stanley was The SF Summit Group, a strong team led by Sean Bricmont and Steve Marotto which brought in upwards of $4 billion in managed assets alone.

Rockefeller Capital Management

Though founded in only 2018, Rockefeller Capital Management can trace its roots to the first single family office that served the Rockefeller family beginning in the late 1800s. Bolstered by its rich history, Rockefeller has achieved rapid growth over its six years, currently managing roughly $35 billion in assets. The firm provides family office, investment banking, and broker dealer services for its 22,000+ clients.

It's clear that the firm has no intention of slowing its growth following First Republic's collapse, pulling over $4 billion in additional AUM from two of their wealth management teams and independent advisor Daniel Selcow. With these acquisitions, Rockefeller is poised to continue to expand and generate high returns for its clients.

Advisors & Wealth Management Teams On the Move

Where have some of First Republic's largest books of business gone since the bank's collapse?

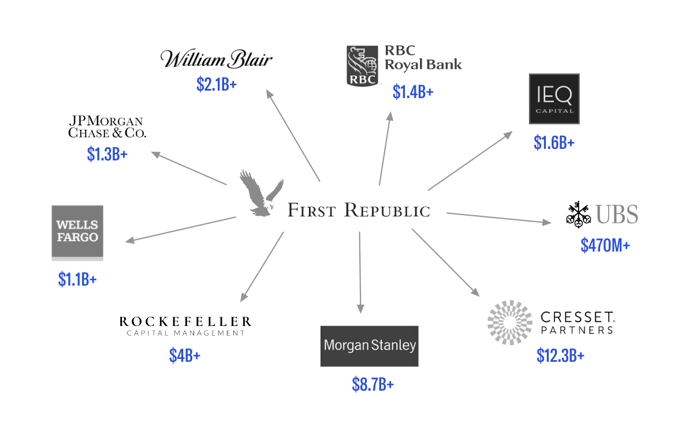

Unsurprisingly, some of the most notable migrations from First Republic Bank have been to other large financial institutions, with total assets under management ranging from $18.5 billion at IEQ Capital to over $1.2 trillion at Morgan Stanley.

The visual below shows the movement of total managed assets of the wealth management teams and individual advisors featured in this report from First Republic Bank to their new respective firms.

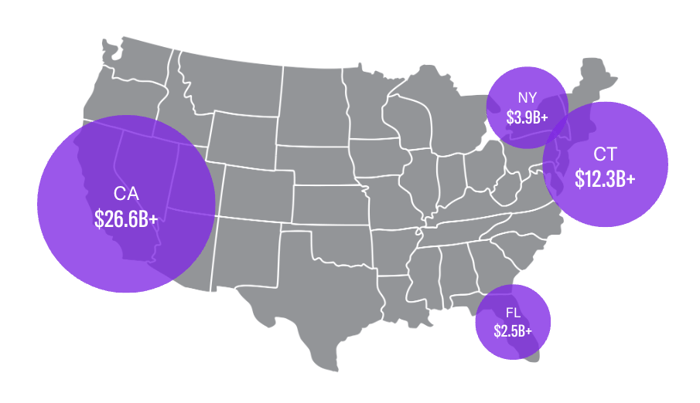

The overwhelming majority of the offices of the private wealth teams and advisors featured in this report are located in San Francisco and throughout the Bay Area, with others located in financial hotspots such as New York City or greater Los Angeles. The map below represents the estimated value of managed assets by team location.

**Constellation Wealth Advisors ($12.3B) operates out of both CT & CA; the team is represented in both states on this map.

Below, we highlight some of the most notable wealth management teams and individual advisors that made the move from First Republic to other financial institutions following the bank's collapse.

Teams and partners are listed together--private wealth group names used where applicable.

Constellation Wealth Advisors

Est. AUM: $12.3B+

George Boudria

David Dudek

Stephen Marotto

Randy Peterson

Steven Levine

Est. AUM: $2.5B+

Liberty Wealth Partners

Est. AUM: $2.3B+

Timothy Deygoo

David Farber

Schuyler Perry

Larry Rothenberg

Shaun Van Vliet

Laura Ward

Est. AUM: $2.1B+

Adam Beard & Jeremy Wenner

Est. AUM: $1.6B+

Adam Beard

Jeremy Wenner

Catherine Kramer & Wendi Doyle

Est. AUM: $1.3B+

Catherine Chase Kramer

Wendi Doyle

Nicholas Davey & Alexander Kadish

Est. AUM: $1.1B+

Nicholas Davey

Alexander Kadish

Marchetti Porter Wealth Partners

Est. AUM: $1.1B+

James B. Marchetti

James L. Marchetti

Caleb Porter

The Todd Halbrook & Adam MacDonald Management Group

Est. AUM: $880M+

Todd Halbrook

Vincent Lovoy

Adam MacDonald

Jeff Coburn

Est. AUM: $760M+

Renee Provencher & Bart Zitnitsky

Est. AUM: $740M+

Renee Provencher

Bart Zitnitsky

Daniel Selcow

Est. AUM: $680M+

Friedman Peters Group

Est. AUM: $540M+

Mark Friedman

Mitchell Peters

Thomas Moore III

Est. AUM: $490M+

Dinh Truong

Est. AUM: $470M+

Natalie Schnuck

Est. AUM: $320M+

Disclaimer: This report and accompanying information has been derived using FINTRX-proprietary data and is not inclusive of all rep/employee movements from First Republic Bank. All information contained within is accurate to the best of our knowledge, including--but not limited to--estimated reported AUM (as of July 2023), job titles, etc. This report and its data are not intended for reproduction and should not be used as official investment advice. FINTRX does not have any affiliation with any persons or entities included in this report. Any use of this report or its contents is at the sole discretion and responsibility of the user. FINTRX shall not be held liable for any errors or omissions in the information provided herein.

About FINTRX

FINTRX is a leading family office & registered investment advisor (RIA) data intelligence solution that provides comprehensive and reliable data on 3,700+ family offices, 20,000 family office contacts, 40,000 RIAs and 850,000 registered reps. Our platform combines data, analytics and intuitive software to help clients identify potential investment opportunities, connect with investors and clients and stay informed on industry trends and developments.

At FINTRX, we leverage advanced AI technology to provide accurate and updated information on family offices and RIAs worldwide. FINTRX data is powered by millions of sources, both public and private, which are constantly updated and verified by our 70+ person research team as well as a team of experienced data scientists. This ensures you have access to the most relevant and timely information available.

Written by: Emery Blackwelder |

July 19, 2023

Sr. Product Marketing Associate at FINTRX

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)