START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Family Offices Harnessing the Power of Deep Tech Investments

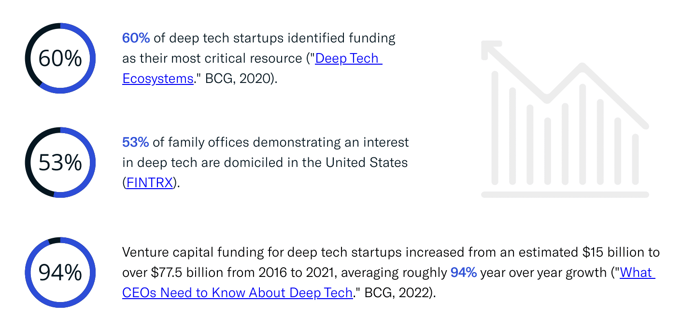

Over the last few years, technology has cemented itself as one of the most prevalent and rewarding investment landscapes for family offices. As technological innovation continues to evolve, business procedures are following suit, ultimately resulting in the emergence of new tech startups at a rate faster than ever before. Consequently, direct family office investment in deep tech companies - a growing subset of the tech industry - is soaring alongside.

Introduction

Deep technologies have the potential to deliver dramatic improvements over advancements currently in use. With that said, large investments and a considerable amount of effort will be necessary to bring these technologies from the lab to the market. In an effort to shine a light on family offices harnessing deep tech opportunities, we have provided a breakdown of data demonstrating this growing trend. Unless otherwise cited, all data within this narrative was derived using the FINTRX Family Office Data and Research Platform.

Defining Deep Tech

Deep tech is a relatively new term, coined in 2014 by Swati Chaturvedi, used to describe a set of disruptive technologies based on scientific discoveries, engineering, mathematics, physics and medicine. However, companies applying existing technologies (such as Uber, for instance) differ from those in the deep tech space which are making veritable advancements in science that have a significant impact on businesses and corporations. To distinguish one phenomenon from the other, the term 'deep tech' was created. Deep technologies present unique opportunities for investors to catalyze change and lay the foundation for further novelties, and family offices are eager to jump on board.

Deep Tech Sectors & Key Terms:

Why would deep tech investments be fruitful for family offices?

Family office investors are frequently characterized as being opportunistic, flexible and patient over the long term. These traits make them ideal candidates for deep tech companies seeking capital. It's important to note, investments into deep tech companies are differentiated from investments into the greater tech industry, as they often require the investor to stake their capital knowing they may not see immediate returns due to the significant amount of scientific research and development required for such companies to come to fruition. Sacrificing short-term alpha, which is a characteristic strategy of family office investors to begin with, is highly rewarding for the deep tech investor, as long-term yields from deep tech investments have not only proved to be highly profitable, but extremely beneficial to societal growth as well.

Today’s innovators have a wealth of technological capability at their fingertips. Over the last few decades, novel advances have been driven by the use of progressive platform technologies (desktop computers, world wide web, mobile technologies, etc.) that ultimately led to a variety of applications in industries across the board. Companies that began as digital businesses are increasingly reshaping their strategies toward deep tech as well. Investors and companies are now looking for the next source of deep tech advances capable of fueling the next industrial revolution.

One of the most notable rising trends, however, is the role of deep tech startups and its increasingly important collaborations with family office investors. Through the FINTRX family office data and research platform, we frequently see allocations into deep tech companies. For example, ICON Technologies, a Texas-based deep tech startup founded in 2017, received both Seed and Series A funding from both single family office, Cercano Management, and multi-family office, Caz Investments between 2018 and 2020. ICON develops advanced technologies that advance humanity through the use of 3D printing robotics, software and advanced materials.

Family Offices Investing in Deep Tech

Companies and investors have a lot to gain from deep technologies, but harnessing their potential advantages takes a new approach to working with external partners. When it comes to family offices, we often see these private wealth entities identifying the capabilities that a startup can leverage (data, client network, business knowledge, facilities, mentors, technical experts, cash flow monitoring, etc.). Besides helping a startup become a potential business partner, giving it access to internal resources can help spread an entrepreneurial spirit which often leads to higher returns in the long run. The dramatic rise in deep tech appeal and its broadening reach to new investor classes is notably emphasized within the global family office market.

Single Family Office vs. Multi-Family Office Breakdown:

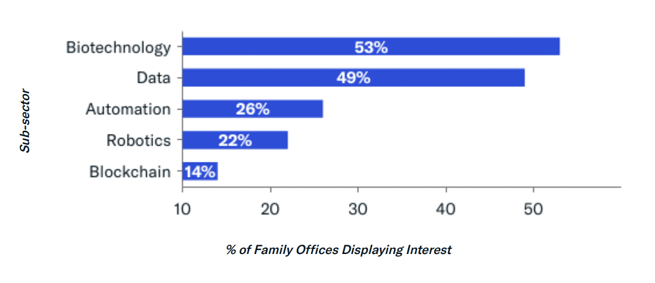

Top 5 Deep Tech Sub-Sectors Amongst Family Offices:

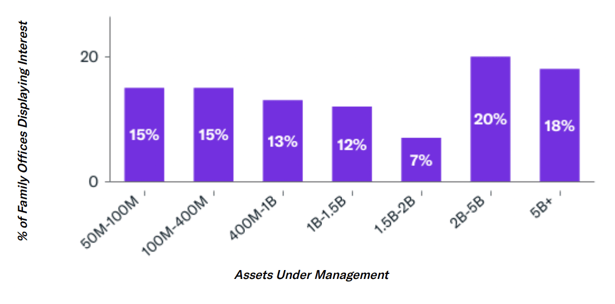

Deep Tech Family Office Investor AUM Breakdown:

Geographic Breakdown

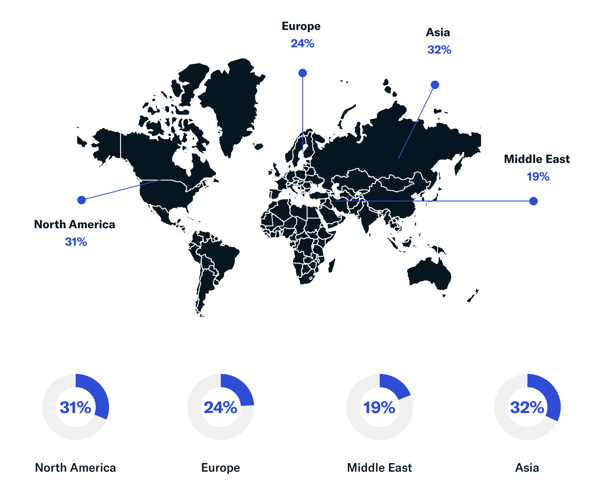

Family office investors are looking elsewhere for 'the next big thing' in tech. Many seek technologies that have the potential to solve major societal and environmental issues, drive economic growth by improving on current products and services, create new markets and enhance underdeveloped countries. As you can see below, deep tech is most prominent among family offices throughout Asia and North America, though this trend has been rapidly gaining momentum across the entire global family office landscape

All data (unless otherwise cited) was derived using the FINTRX Family Office Data and Research platform.

Conclusion

The technology landscape is constantly evolving, but companies need to know today which technologies will drive the greatest digital disruption and economic change over the next decade. Although deep tech is still in its earlier stages, it is almost guaranteed to be a defining investment for family offices moving forward. Not only does this landscape allow for remarkable change, but such advances allow their family office to flourish for generations to come. Popularity in deep technologies is only beginning to grow, proving to be exceedingly advantageous to early investors. There is no doubt that this subset of the tech industry will continue to transform businesses and society as a whole. That said, the time to craft a deep tech investment strategy is now.

Highlights:

-

- Deep tech lies at the crossroads of a massive shift in demand led by trends such as global climate change, demographic shifts, resource scarcity and an aging population - trends which have an impact across all industries.

- Companies themselves have a lot to gain from deep technologies, but harnessing their potential advantages takes a new approach to working with external partners.

-

- Increased sophistication allows for more opportunities to broaden internal investment capabilities.

Download the PDF

FINTRX provides comprehensive data intelligence on 850,000+ family office & investment advisor records, each designed to help you identify, access and map the private wealth ecosystem. Explore in-depth dossiers on each family office & investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors & industries of interest and advisor growth signals, among other key data points.

Find relevant decision-makers in a snap with powerful search filters and queries. Uncover the data you need, when you need it and filter through areas of investment interest, AUM, asset flows, intent signals, potential associates and much more. FINTRX sources data from both public and private sources and has a team of 70+ researchers who map, validate and compile data daily to ensure its accuracy.

For an in-depth exploration of the FINTRX family office platform, click below:

Written by: Emery Blackwelder |

March 14, 2023

Sr. Product Marketing Associate at FINTRX

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)