START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Family Offices Directly Investing in Multifamily Residential Properties

With the growing need for housing around the U.S., multifamily residential properties remain a preferred property type for the bulk of family offices, according to industry experts. Having learned from missed opportunities a decade ago, many ultra-high-net-worth players are looking for new opportunities to invest in multifamily residential properties. Often, we see family offices going the direct route if they have the team and skills in place to do so, or they might invest alongside a like-minded group. Either way, family offices are strategically looking for investment opportunities in real estate, specifically regarding multifamily residential properties, as there are many benefits to doing so.

Multifamily Residential Properties: An Overview

Multifamily residential is a classification of housing where multiple separate housing units for residential inhabitants are within one or several buildings within one complex, such as an apartment. Properties with 5+ units typically qualify for different types of financing, which is often more expensive than residential properties. Larger properties, those with five or more units, often fall into the commercial real estate category. Multi-family residential real estate is optimal for investors, hoping to build a large portfolio of rental units.

According to a recent report from the National Association of Realtors (NAR), the housing market is well past the recovery phase, booming with higher home sales compared to pre-pandemic days. Private equity firms, family offices, and even hedge funds capitalized on the opportunity, funneling billions of dollars in private capital to buy cash-flowing apartment complexes and condominiums.

Benefits of Investing in a Multi-Family Property

For investors seeking real estate investment opportunities to grow monthly income and long-term wealth, multifamily property investments are a great option for several reasons. Multifamily residential real estate continues to be a solid investment for those seeking to build capital over the long term, as they typically accumulate wealth faster than single-family homes and are less complicated than investing in office space, retail, hotels, and other property types. Listed below are some of the additional benefits.

- Cash Flow & Tax Benefits: Ample cash flow, appreciation of assets and tax benefits

- Leverage & Control: Allows investors to manage a greater number of assets with significantly less of their own capital

- Scale Faster: Achieve scale faster by acquiring a multi-family residential property versus single-family rental units

- Easier to Finance & Less Risk: Higher cash flow and the lowered risk of a vacant building mean less risk for the lender

- Community Improvement & Growth: Adds value to communities by providing a quality rental option with the opportunity to provide affordable housing

What Makes Multifamily Residential Real Estate an Attractive Investment for Family Offices?

Multifamily residential properties have long been a favored investment of family offices because they produce high risk-adjusted returns over the long term as compared to other property types. According to Evergreen Property Partners’ annual survey, multifamily residential apartments have extended their lead as the top real estate investment option for family offices.

Now, more families that generated their wealth through other industries and sectors are allocating capital towards real estate, allowing them to create and maintain wealth for generations to come. Since the start of the pandemic, banks have pulled back on lending for many early development projects, and family offices are stepping in to help bridge the gap.

Regional Breakdown

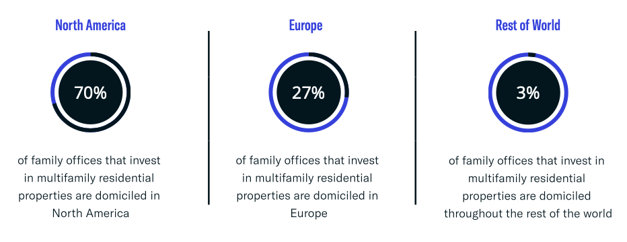

Geographic location often plays a significant role in the investment preferences of family offices. Throughout our research we have found that 61% of total family offices live in North America, 27% live in Europe and 12% are throughout the rest of the world. Here, you can see that 70% of family offices interested in multifamily residential properties are based in North America, followed by Europe at 27%.

Asset Class Interest Breakdown

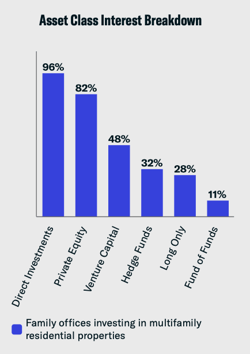

Asset allocation can be a key determinant for total return potential and risk characteristics. Throughout our research, we found that 56% of family offices invest directly, while 81% of family offices invest in private equity. Additionally, 65% of family offices allocate to real estate.

Most asset class interests align with the family office landscape. However, it appears direct investments continue to be the most popular regarding family offices investing in multifamily residential real estate at 96%. Next is private equity at 82%, venture capital at 48%, hedge funds at 32%, long-only at 28%, and fund of funds at 11%.

Assets Under Management Breakdown

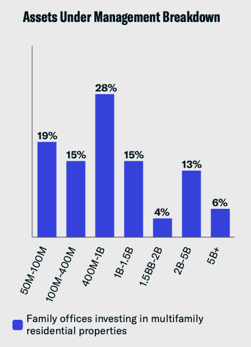

Here, we outline the assets under management (AUM) breakdown of family offices that have directly invested in multifamily residential properties.

Here, we outline the assets under management (AUM) breakdown of family offices that have directly invested in multifamily residential properties.

The most prevalent among this sample size are family offices with AUM between $400M-$1B at 28% followed by those with AUM between $50M-$100M at 19%.

Next are those with AUM between $100M-$400M and those with AUM between $1B-$1.5B at 15%, respectively.

Industry Origin of Wealth Breakdown

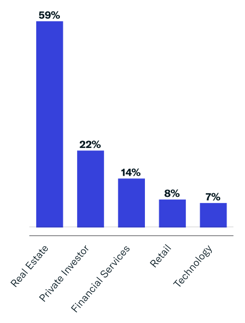

FINTRX data shows that 19% of total family offices made their wealth in real estate. About 25% of total family offices made their wealth in private investing, 8% of total family offices made their wealth in retail, and 11% made their wealth in the technology space.

Here we provide the top five industries regarding industry wealth origin of family offices investing in multifamily residential real estate.

Real estate leads the group at 59%, followed by private investments at 22%, financial services at 14%, retail at 8%, and technology at 7%.

Direct Transactions

Direct investments continue to gain traction throughout the family office space, particularly with regard to single-family offices. Over the past decade, family offices have accumulated the assets and talent required to allocate capital directly into the private space.

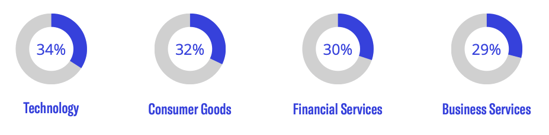

Data here shows the percentage of multifamily residential family office investors that directly invest in a specific sector out of the total number of multifamily residential family office investors. 34% of multifamily real estate investors also invest in technology, 32% invest in consumer goods, 30% take interest in the financial services space, and 29% of this specific subset directly invest in business services.

Conclusion

Family offices are well-positioned to capitalize on many opportunities arising within the current market environment. Because family offices seek to make money over the long term, they need a diverse investment strategy to do so. Real estate is a key aspect of that diversification, as it offers a reliable source of cash flow alongside long-term capital appreciation. Having a safe and assured income is now more important than ever.

Family offices are making some big deals and joining other family offices to invest along with them. While family offices’ primary goal: wealth preservation and long-term growth, is consistent, the manner in which family offices achieve that goal can take many forms. Some family offices prefer the hands-off approach of investing through private equity firms. Others take a more active role by directly investing in real estate. Both strategies have a track record of yielding successful results.

With the current market climate trending toward real estate, specifically regarding multifamily residential properties, more family offices will likely jump on board in the coming years. Although the multifamily landscape has changed drastically, data shows the sector remains relatively resilient.

Download the PDF

FINTRX provides comprehensive data intelligence on 850,000+ family office & investment advisor records, each designed to help you identify, access, and map the private wealth ecosystem. Explore in-depth dossiers on each family office and investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors & industries of interest, and advisor growth signals amongst other key data points.

For an in-depth exploration of the FINTRX family office platform, request a demo below.

Written by: Renae Hatcher |

July 15, 2021

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)