START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Family Offices Continue Moving Towards Direct Investments

The shift toward direct investing within the family office ecosystem shows no sign of slowing down. The once passive, fund-heavy family office has evolved into a more sophisticated and entrepreneurial force in the private capital markets. This evolution is transforming how family offices allocate capital, evaluate opportunities, and build long-term partnerships. The growing preference for direct investments offers these private wealth entities a range of strategic and financial advantages. Let’s unpack a few of the key drivers behind this trend.

The growing preference for direct investments offers these private wealth entities a range of strategic and financial advantages. Let’s unpack a few of the key drivers behind this trend.

Increased Control

Today’s modern family office seeks more than a passive stake. For many, particularly single family offices, direct investing is about having a seat at the table. Beyond financial returns, these investors want influence, transparency, and the ability to contribute value beyond capital.

Control enables family offices to align investments with their personal philosophies, long-term goals, and legacy priorities. This active engagement model fosters stronger relationships with founders and portfolio companies and ensures that decisions reflect the family’s broader mission.

SOURCE : FINTRX DATABASE

SOURCE : FINTRX DATABASE

Patient Capital and Longer Hold Periods

Unlike private equity funds that often operate on defined timelines and exit horizons, family offices have the freedom to invest for the long term. This flexibility allows them to deploy what’s known as patient capital, funding that isn’t driven by short-term performance targets but by sustainable growth. Patient capital aligns the interests of both investor and operator, supporting businesses through multiple stages of development without the pressure of premature exits. The stability and longevity of this capital make family offices particularly attractive partners for private companies seeking growth with strategic guidance rather than transactional capital.

Domain Expertise and Strategic Value

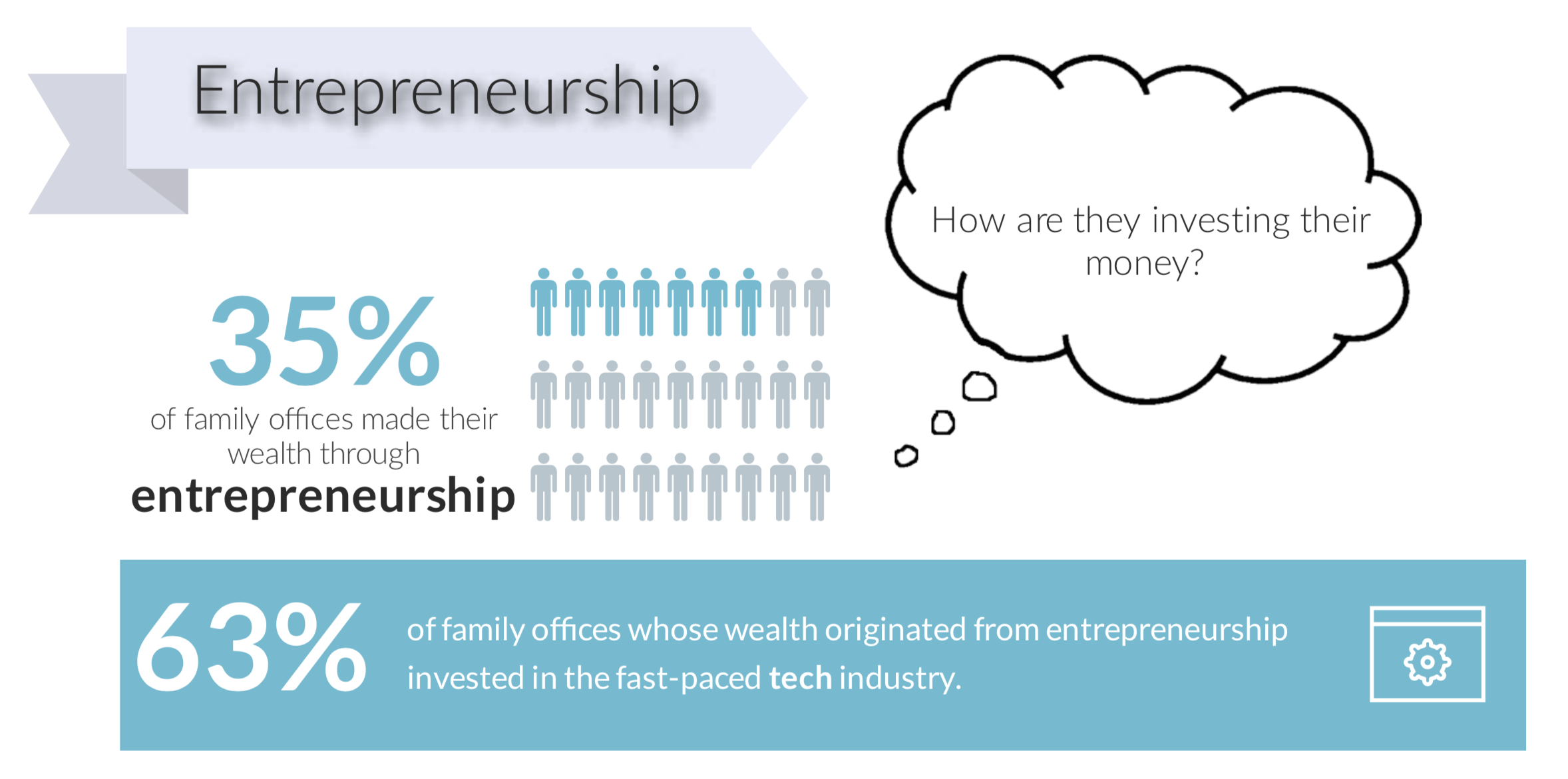

Perhaps one of the most powerful aspects of direct family office investment is domain expertise. When a family’s wealth originates from a specific industry, such as technology, healthcare, or real estate, they bring unique insight, networks, and operational experience to the companies they invest in.

For example, a family office that built its fortune in technology can provide more than just capital to a startup in the same space. It can offer mentorship, strategic partnerships, and introductions that accelerate growth. This synergy creates value for both sides: the operator gains an informed, experienced partner, and the family office deepens its engagement in industries it knows best.

The Broader Market Shift

As family offices continue to mature and institutionalize, their appetite for direct deals will only grow. These groups now possess the infrastructure, talent, and analytical tools once exclusive to large investment firms—allowing them to independently source, evaluate, and manage private investments.

According to FINTRX data, thousands of family offices worldwide are already allocating capital directly to companies across technology, real estate, healthcare, and emerging sectors.

The trend is clear: direct investments are no longer the exception but the expectation among modern family offices.

Looking Ahead

The continued rise of family office direct investing represents a powerful shift in private capital markets. For founders and asset managers, engaging with these investors offers access to patient, strategic capital, backed by experience, networks, and a shared vision for long-term growth.

At FINTRX, we track and analyze this evolving landscape across 4,300+ family offices and 27,000+ decision makers worldwide. Our all-in-one data intelligence platform provides visibility into where these offices are allocating capital, what industries they favor, and how best to connect with them.

Ready to explore the family offices actively investing in private markets? Request a FINTRX demo today to see how our platform helps you discover, engage, and build relationships with leading family office investors.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)