START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Alternative Assets: A Guide for Asset-Raising Professionals

Alternative assets are often considered a valuable addition to traditional investment portfolios due to their non-traditional nature and potential for high returns. However, asset-raising professionals often face unique challenges when it comes to identifying, sourcing and raising capital for alternative assets. In this guide, we'll take a closer look at alternative assets and explore how to navigate this complex and ever-changing landscape. We'll examine key trends and considerations for raising capital in asset classes such as private equity, venture capital, real estate and more. Whether you're new to the industry or a seasoned professional, this guide will provide you with valuable insights to help you succeed in the world of alternative assets.

Alternative Assets: An Overview

Alternative assets are a type of investment that goes beyond traditional stocks, bonds, and mutual funds. Alternative assets can include a wide range of investments such as private equity, real estate, hedge funds, commodities, art, collectibles, cryptocurrencies, and more. These assets are often less liquid and may require specialized knowledge and expertise to understand and evaluate properly. Alternative assets can provide diversification benefits, unique opportunities for generating alpha and can help investors reduce risk and enhance returns.

The types of alternative assets include, but are not limited to:

-

Private Equity

Venture Capital

Real Estate

Hedge Funds

Private Debt

Private Credit

Infrastructure

Direct Investments

Fund of Funds

Commodities

Crypto Funds

Derivatives

Art Funds

Wine Funds

Please note there are many other types of alternative assets that investors can consider.

Benefits of Alternative Assets

Offering alternative assets can provide several benefits for asset-raising professionals. Firstly, it can help to differentiate their firm and attract new clients. By providing access to unconventional asset classes or strategies, you demonstrate specialized expertise and cater to diverse investor preferences. This distinct offering can help your firm attract a broader client base and cement its reputation as an innovative leader in the financial industry.

Alternative assets can showcase your firm's ability to generate alpha and manage risk, through enhanced diversification and uncorrelated returns. This diversification helps investors reduce risk by spreading their exposure across a wider range of assets, thereby mitigating the impact of market fluctuations on their overall portfolio. Incorporating alternative assets into an investment strategy can lead to a more balanced, resilient portfolio with improved risk-adjusted returns.

Offering alternative assets can help asset-raising professionals build stronger relationships with their clients and become trusted partners in managing their wealth. By providing access to unique investments, they demonstrate a deep understanding of clients' financial goals and risk tolerance, while catering to diverse preferences. This specialized expertise, coupled with the ability to generate uncorrelated returns and manage risk through diversification, fosters trust and credibility. As a result, clients are more likely to view these professionals as valued partners in the long-term management of their wealth.

Challenges of Alternative Assets

Alternative assets also present some challenges that warrant careful consideration. For instance, these assets are often complex and require a specialized understanding for accurate evaluation. Alternative assets can also be illiquid, meaning they can't be easily bought or sold like traditional investments. This can lead to longer holding periods and potentially limit the investor's ability to quickly access their capital.

Additionally, alternative assets can be costly, both in terms of fees and due diligence costs. The due diligence process involves a comprehensive assessment to ensure a thorough understanding of the investment opportunity. Key aspects of this process often include analyzing the asset's structure, evaluating the management team's expertise, examining the underlying strategy or business model, assessing risks and regulatory compliance and reviewing historical performance and projections. As a result, asset-raising professionals must carefully consider the potential challenges of offering alternative assets and develop strategies to mitigate these challenges.

Key Trends & Considerations for Raising Capital in Alternative Assets

When it comes to raising capital in alternative asset classes, there are several key trends and considerations that are important to keep in mind. Below are just a few:

Increasing Investor Demand: Over the past few years, there has been a significant increase in investor demand for alternative asset classes such as private equity, real estate and hedge funds. As a result, many firms are focusing on raising capital in these areas to meet this demand.

Competition for Capital: With the rise in investor demand for alternative asset classes, there has also been a corresponding increase in competition for capital. As a result, firms need to be strategic in their approach to raising capital and differentiate themselves from others in the market.

Importance of Relationships: In the alternative asset class world, building strong relationships with clients, investors and financial advisors is vital to driving long-term success. It is important to establish trust and foster open communication channels to ensure all parties feel heard and valued. These relationships can lead to increased deal flow, better investment opportunities and higher client satisfaction.

Emphasis on Transparency: Investors in alternative asset classes are increasingly demanding transparency around fees, performance and other key metrics. Firms that can provide this transparency are likely to be more successful in raising capital.

Shift Towards ESG: Environmental, social and governance (ESG) considerations are becoming increasingly important to investors in the alternative asset class world. Firms that can demonstrate a commitment to ESG principles are likely to be more attractive to investors.

Importance of Networking & Relationship-Building

As mentioned above, networking and relationship building are crucial components of success in the private wealth industry. Building a solid network requires effort, time, and patience but can pay off in the long run. By regularly reaching out to contacts, sharing valuable insights and showing genuine interest in their business or objectives, professionals can develop a reputation as trusted advisors who add value beyond just financial returns. Ultimately, networking is about building relationships, which requires consistent effort, attention, and care. The stronger the relationship, the better positioned the professional is to offer sound advice and drive successful outcomes for all parties involved.

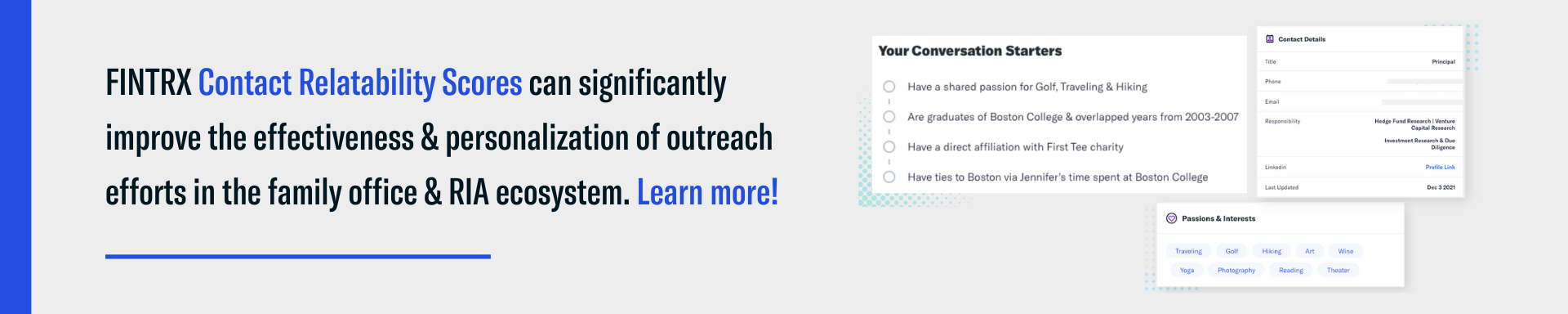

FINTRX's Affinity Relatability Scores is a unique feature that helps users humanize their outreach with contacts by leveraging commonalities. This feature provides a score between 1-100 on the strength of relatability, custom conversation starters, actionable insights, and meaningful intel. Users can also toggle this feature on and off as they choose within their account settings. By filling out their own affinity background information, users can better identify potential relatability areas based on a wider variety of data. Learn more about this powerful feature by clicking the image below.

Technology's Role in Offering Alternative Assets

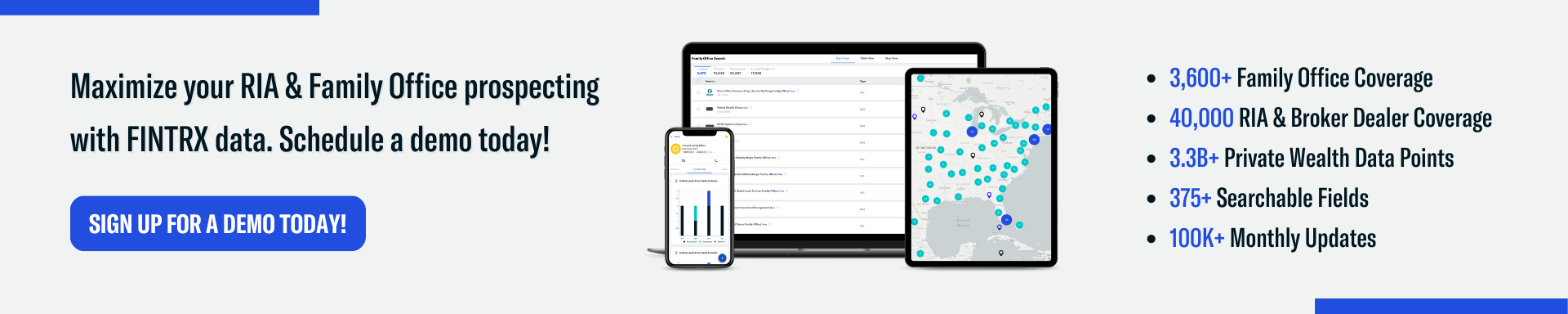

Technology has played a crucial role in offering alternative assets to investors. With the advent of advanced software such as the FINTRX Private Wealth Data Intelligence Solution, financial institutions can now provide investors with access to a wide range of alternative asset classes, including private equity, hedge funds, commodities, real estate and more. Technology has also made investment research and analysis more efficient, enabling investors to make better-informed decisions about which alternative assets to invest in.

By leveraging advanced software and data analytics technologies, FINTRX enables investors to search for and analyze investment opportunities based on a range of criteria, including sector, asset class, location and investment stage. The FINTRX financial advisor database provides investors with detailed information on family offices and RIAs that are active in alternative asset classes, making it easier for them to build relationships and ultimately access a wider range of investment opportunities. FINTRX is a prime example of the role that technology can play in democratizing access to alternative assets and driving greater investment opportunities for clients.

Written by: Renae Hatcher |

April 14, 2023

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)