A Company Fueled by Innovation & Teamwork

Providing accurate and comprehensive private wealth intelligence - empowering access to decision makers and increased efficiency.

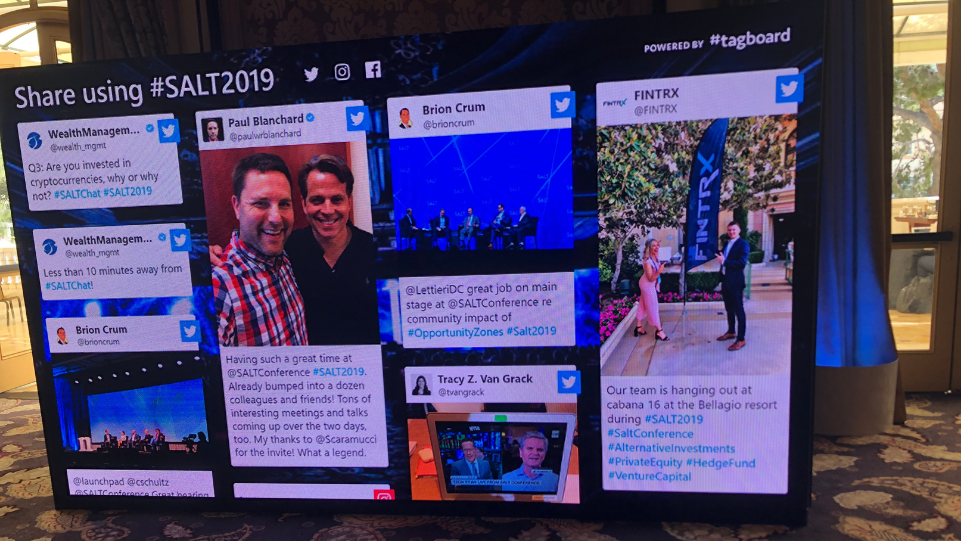

Life at FINTRX

Collaborative With a Shared Mission

.png)

-1.png)

About FINTRX

Founded in 2014 and based in Boston, MA, FINTRX is the preeminent family office and registered investment advisor intelligence platform. We deliver the data, research and tools that leading asset managers and financial firms rely on to efficiently access the private wealth ecosystem. FINTRX pairs over a million data records with artificial intelligence - designed to empower our customers and deliver successful outcomes.

KEY HIGHLIGHTS

2014

Established in Boston, MA

85+

Dedicated Team Members

20+

Countries Served

1,000+

Active Customers

Our Mission

At FINTRX, our mission is to deliver the most efficient path to access the global private wealth ecosystem. Our powerful yet easy-to-use platform provides an intuitive way to discover the right investors, opportunities and decision makers - all while saving you valuable time.

Press & Media Mentions

FINTRX CEO Named Top 100 CEO In Boston

Comparably

FINTRX Raises $9M in Series A Funding

Finsmes

More Wealthy Families Are Throwing a Lifeline...

New York Times

-2-1.png?width=130&height=19&length=200&name=Untitled-Project%20(6)-2-1.png)

Why Family Offices Are Chasing Direct Deals

Business Insider

Look beyond the label in choosing a modern...

Financial Times

6 Family Office Trends In Direct And Venture...

Forbes

Family Office Capital Pumps Up Private-Equity...

Wall Street Journal

Why the hubris of Indian family offices is raising...

Asian Investor

Family Office Increasing Direct Investments...

Charles Schwab

What are High-Net-Worth Individuals Investing in...

Motley Fool

Rising rich boost stature, growth of family offices

InvestmentNews

Direct Investing Is Rising Among Family Offices

PE Insights

Recent Reports & White Papers

5 Largest Family Office Direct Deals of November 2025

November delivered another surge in family office activity, with private wealth concentrating capital in AI, energy innovation, and frontier technology. FINTRX data surfaced multiple billion-dollar rounds where family offices invested..

5 Family Offices Investing in FinTech Companies

FinTech is no longer just a venture capital story; it’s increasingly a family office allocation theme. As payments, infrastructure, compliance, and embedded finance reshape how capital moves, select family offices are leaning in as strategic,..

RIA & Broker-Dealer Roundup: November '25 Moves, M&A Deals & Emerging Players

In the November edition of the Registered Investment Advisor (RIA) & Broker-Dealer (BD) Roundup,FINTRX--your trusted source for AI-powered private wealth data intelligence--details the most notable advisor and team moves, M&A deals, and new firm..

Using FINTRX AI to Find Family Offices & RIAs Allocating to Strategies Like Yours

Being successful in raising capital isn’t about blasting outbound emails or sifting through outdated spreadsheets. It’s a precision game—one where the winners understand the why behind investor allocations and tailor their outreach to the..

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)